Investors and traders are in no mood for major risk-taking Monday morning as the next Federal Reserve meeting approaches.

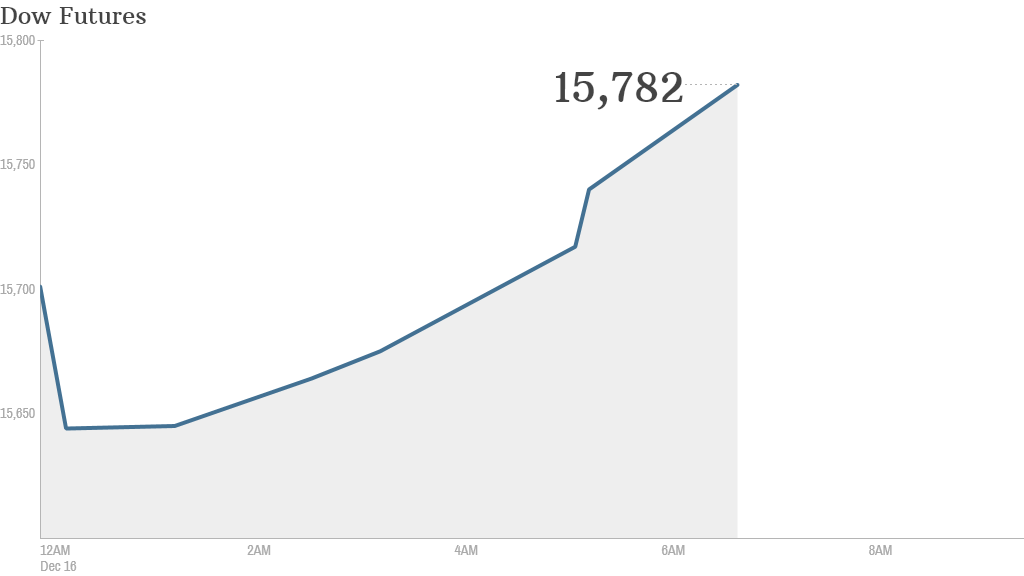

U.S. stock futures were modestly higher ahead of the opening bell.

Investors are treading cautiously as they wait to see whether the Federal Reserve will begin cutting back on its massive stimulus program -- which has supported stock markets around the world -- as economic data continue to improve.

"[A] growing minority now believe that the Federal Reserve could start to taper at this week's meeting," said Kathleen Brooks, a research director at Forex.com. "Only a few weeks ago this was virtually unheard of, with most traders and investors looking at late Q1-Q2 2014 for the Fed to start tapering."

The Fed has been pumping $85 billion per month into the financial system since September 2012. It will announce any policy changes after it wraps up its two-day meeting Wednesday afternoon.

Related: Markets are ready for the Fed

In corporate news, Google (GOOG) agreed to buy military robot maker Boston Dynamics, a builder of military robots.

Shares of Sprint (S) rose in premarket trading following reports from The Wall Street Journal that it was working on a deal to acquire T-Mobile (TMUS).

AIG (AIG) reached an agreement to sell its airline leasing business to AerCap Holdings (AER) for $5.4 billion.

On the economic data front, the New York branch of the Federal Reserve is set to release its monthly manufacturing survey at 8:30 a.m. ET Monday, while the Labor Department will release its revised estimate of third quarter productivity.

At 9:15 a.m. ET, the Census Bureau will publish its monthly reports on industrial production and capacity utilization.

Related: Fear & Greed Index feels fear

U.S. stocks finished a losing week with a whimper.

European markets were climbing in morning trading, with Germany's benchmark Dax index up by roughly 0.6%.

Asian markets ended with losses. The Nikkei in Japan slumped by 1.6% as the yen strengthened, hitting companies that depend on exports.