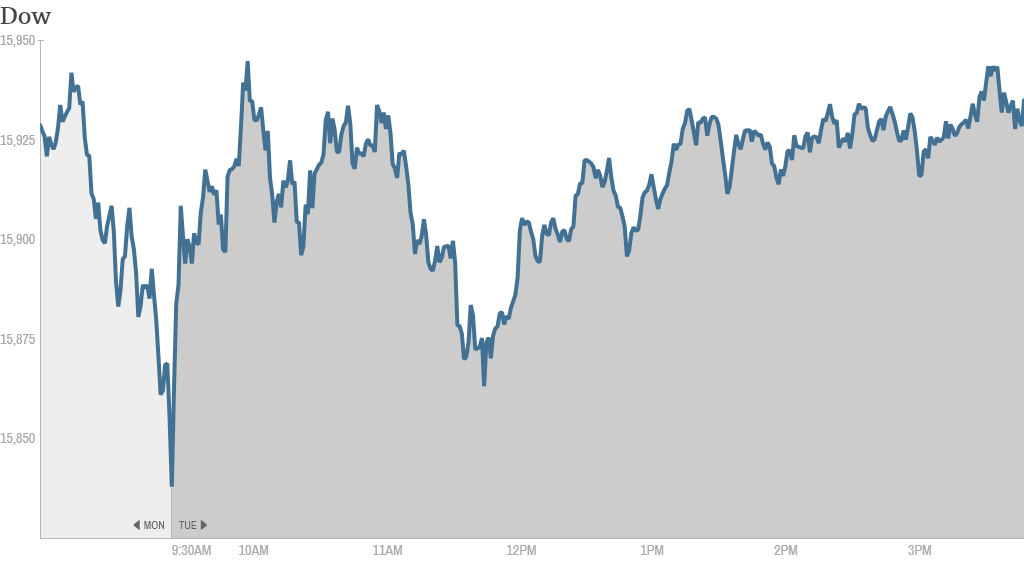

Stocks bounced back Tuesday as emerging market turmoil eased and investors sifted through the latest earnings reports.

The Dow gained 90 points, while the S&P 500 and Nasdaq also got a bump.

The win snapped a five-day losing streak for the Dow.

It's been a rough month for investors. All three major indexes have bounced around over the past few weeks and are down slightly for the month.

But investors regained some confidence Tuesday as the flight from emerging markets slowed and the currencies of some troubled economies stabilized.

Investors also geared up for the Federal Reserve's policy announcement Wednesday afternoon.

In economic news, the Case-Shiller 20-city home price index rose slightly, signaling that the housing market remains strong but is showing signs of topping out.

Investors will also keep tabs on President Obama's fifth State of the Union address Tuesday evening. The economy has been issue No. 1 for the president but that hasn't always translated into good news for many Americans.

Related: Obama's economy in 17 charts

Earnings season is in full swing: Shares of Apple (AAPL), a prominent member of CNNMoney's Tech 30 Index, tumbled 8% after the tech giant reported weaker-than-expected fourth quarter iPhone sales.

The stock couldn't break out of its rut even after activist investor Carl Icahn said he bought another $500 million worth of shares, on top of the $1 billion he bought last week. Icahn has waged a public campaign advocating that Apple return cash to shareholders through a stock buyback.

"$AAPL normally after an icahn tweet the stock jumps..this time the mkt said so what," said StockTwits trader Nodrog1.

"$AAPL Forward guidance trumps Icahn today," argued Riverwalk, alluding to the company's conservative outlook for the current quarter.

Related: Fear & Greed Index swallowed by fear

In sunnier tech news, Netflix (NFLX) shares got a boost after a report surfaced claiming the company plans to expand to Europe.

Abercrombie & Fitch (ANF) soared almost 5% after the retailer announced it was separating its chairman and CEO roles and doing away with its shareholder rights plan, or so-called poison pill. The latter move would make it easier for the company to sell itself.

Pfizer (PFE) popped after the drugmaker reported better-than-expected earnings, though sales fell short of estimates.

Ford (F) shares finished flat after initially rising when the automaker topped earnings forecasts and said it would pay record profit sharing to its UAW members.

"$F...This is how you run a company," said Berbacharat on StockTwits, adding that he was impressed with the company's dividend and investor relations.

American Airlines Group (AAL), the child of the recently completed merger between American Airlines and U.S. Airways, reported a fourth-quarter profit that beat estimates.

Shares surged almost 6% Tuesday.

"$AAL...Airlines are no brainer for 2014," said StockTwits user Carpathian, referring to the fact that airlines stocks are on a tear.

Yahoo (YHOO) jumped in 5% in after-hours trading after its earnings beat analysts' estimates, though revenue was in line with expectations.

Emerging markets turmoil eases: Emerging markets have returned to center stage over the past few days as protests and wild currency fluctuations led to a sweeping sell-off.

Turkey's central bank will hold an emergency meeting Tuesday afternoon in an effort to halt the lira's steep decline. And India surprised investors with a rate hike to combat rising prices.

Related: Is this an emerging markets crisis?

The turmoil has been sparked, in part, by the Fed's plans to reign in the flow of cheap money. Investors expect the Fed to announce a further cut to its bond-buying program Wednesday, which could prompt a withdrawal of cash from vulnerable emerging markets.

But some analysts argue the problems in emerging markets can't be blamed on the Fed.

Michael Shaoul, CEO of Marketfield Asset Management, which oversees more than $20 billion, blames years of poor economic policy, mixed with unstable and sometimes corrupt local governments.

He notes that interest rates have gone down in recent weeks, despite the Fed's December announcement about cutting the size of its monthly bond purchase program.