The bulls and bears had a tug of war Thursday as they debate corporate earnings, renewed geopolitical tensions and a recent spate of merger news.

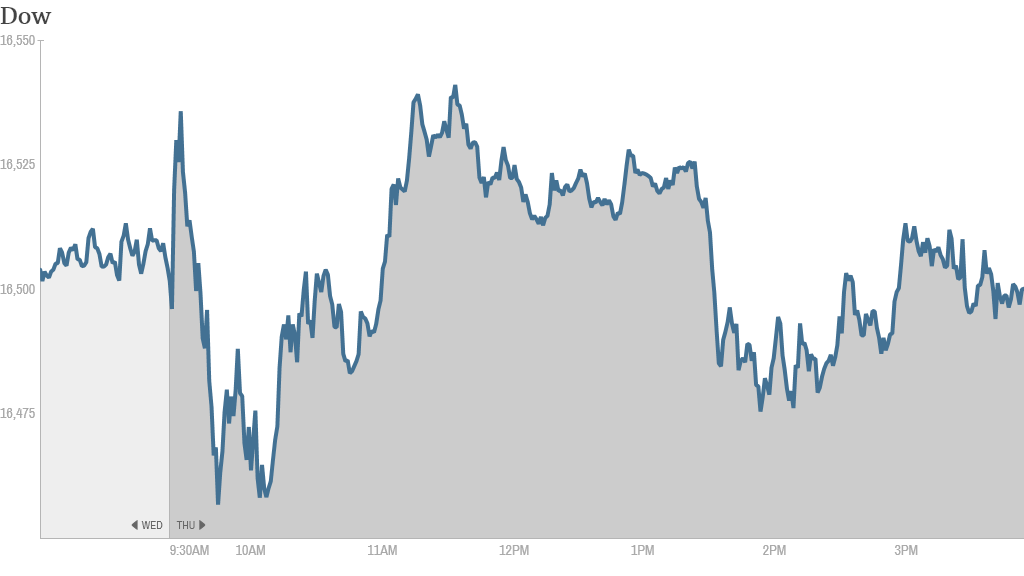

The Dow Jones industrial average ended flat. The S&P 500 and the Nasdaq both posted small gains. All three indexes drifted between small gains and losses throughout the day. Only the S&P 500 is up for the year so far.

Late breaking news

After the market closed, Microsoft (MSFT) reported earnings that topped analysts' expectations, another victory in the tech sector that sent the stock up over 2% after hours. Amazon's (AMZN) earnings were in line with what analysts had predicted, though revenue was slightly better than expected. It popped up over 5% after the news. Starbucks (SBUX) reported results that met expectations, although its revenue outlook for the rest of the year is lower than anticipated. The popular coffee maker's stock rose in after hours trading.

Tech talk

Apple (AAPL) was one of the big winners Thursday after the iPhone maker announced late Wednesday that it was expanding its stock buyback program and increasing its dividend, while reporting quarterly results that beat expectations.

The company also revealed a seven-to-one stock split, which will make it easier for individual investors to buy a slice of the tech giant. A single share in Apple currently costs over $500. The stock ended the day up 8.2% Thursday.

Apple was the top trending ticker on StockTwits, where investors were buzzing about the buyback and stock split. It was as if Apple's earnings were an afterthought. "pssst. did u hear? $AAPL reported earnings :-)," read a post by racernic.

Related: Apple shares soar on stock buyback news

Facebook also beat expectations, helped by strong mobile advertising numbers. Investors seemed to want even more though. The stock ended the day down slightly.

Not all the news in the tech sector was good. Shares of Xilinx (XLNX) sank after the maker of devices and software used in a variety of industries reported quarterly results that missed analysts' expectations.

Netflix (NFLX) shares also fell as investors continue to digest the company's plan to raise prices for its online streaming service.

The Ukraine factor

Stocks came under pressure earlier in the day amid new worries about Ukraine, where government forces clashed with pro-Russian fighters in the southeastern city of Slavyansk.

Russian President Vladimir Putin said any military action would "have consequences" for the government in Kiev. Russian forces are reportedly planning to conduct military drills in response to the action in Ukraine.

"$SPY the 'hot' shooting war in the eastern Ukraine has started. Putin getting ready to roll. Next up, sanctions! Ignore at your peril," read a post on StockTwits by BDF_NYC.

Gold prices jumped after the news broke, though the rally has since lost momentum.

Looking beyond tech

Thursday is a busy day for earnings reports as well. General Motors (GM) reported a $1.3 billion charge relating to a massive recall involving faulty ignition switches linked to at least 13 deaths. But excluding that charge and other one-time items, GM's earnings easily topped forecasts.

Related: GM's $1.3 billion recall costs wipes profits

UPS (UPS) blamed the snowy weather for weak first quarter results even though people have been sending more packages, especially e-commerce sites.

Caterpillar (CAT)reported earnings that topped analysts' expectations and issued an upbeat outlook. The construction equipment maker, considered a bellwether for the global economy, reported solid growth in China.

"$CAT nice!!! after many many months red, Im going green again here in my long-term portfolio..." read a post by gabbs.

Related: Fear & Greed Index still shows fear

Merger Thursday

Zimmer Holdings (ZMH) announced plans to buy Biomet in a cash and stock deal valued at more than $13 billion. The combined company will be one of the largest makers of orthopedic devices. Zimmer shares surged 13%.

Shares of AstraZenec (AZN)gained after the firm reported better-than-expected earnings. AstraZeneca was in the spotlight earlier this week after it was reported that Pfizer (PFE) had considered buying the company for £60 billion ($100 billion). Some think an offer may yet come.

Meanwhile, Alstom (ALSMY) shares surged by roughly 12% Thursday following a Bloomberg report that General Electric (GE) may make a multi-billion dollar bid for the company. The French maker of turbines and trains said it was "not informed" of a takeover offer.

On the economic front, initial claims for unemployment benefits rose in the past week. But a report on new orders for long-lasting goods in March came in better than expected.

European and Asian markets ended with mixed results.