It could be a nervy session for markets Friday as geopolitical tensions shake investor sentiment.

Here are the 5 things you need to know before the opening bell rings in New York:

1. World markets extend slide: World markets fell further on Friday on fear of escalating tensions in Ukraine after a Malaysia Airlines plane crashed in the east of the country.

The U.S. believes Flight MH17 was brought down by a surface-to-air missile over a region that has seen heavy fighting between pro-Russian separatists and Ukrainian government forces.

Analysts say the tragedy could damage business confidence, particularly in Europe, but may also bring the crisis in Ukraine to a head by increasing the pressure on Moscow to resolve the conflict.

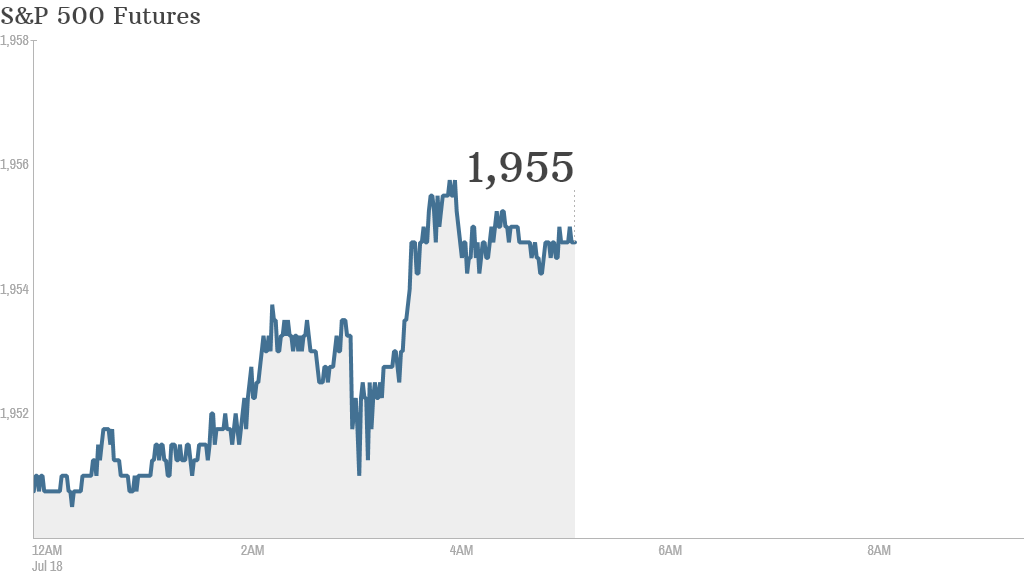

2. U.S. futures flat: U.S. stock futures were holding steady after Thursday's sharp sell-off, which gathered pace on news that Israel had sent ground troops into Gaza.

The flurry of geopolitical concerns sent the VIX (VIX), a key measure of market volatility to its highest level in three months Thursday.

The Dow Jones Industrial Average lost 161 points, while the S&P 500 was off about 1.2%, and the Nasdaq finished down 1.4%. It was the biggest drop for the Dow in two months, and the S&P's fall is the biggest for the index in three months.

3. Earnings season continues: General Electric (GE) and Honeywell (HON) will report earnings before the opening bell.

Google (GOOGL) shares gained 1.7% premarket after the company reported another quarter of surging sales growth. News that Japan's Softbank has hired away Google's global sales chief Nikesh Arora may pique investor interest.

4. Economic data diary: The University of Michigan will post its consumer sentiment measurement at 9:55 a.m. ET.

5. Tax inversion deal: Drugmaker AbbVie (ABBV) could unveil a deal to buy Shire (SHPG) as early as Friday, according to reports. The $54 billion acquisition would be the latest by a U.S. firm looking to move its tax base overseas to save money.