A dose of healthy company earnings gave investors extra energy Tuesday.

Here's are the key takeaways:

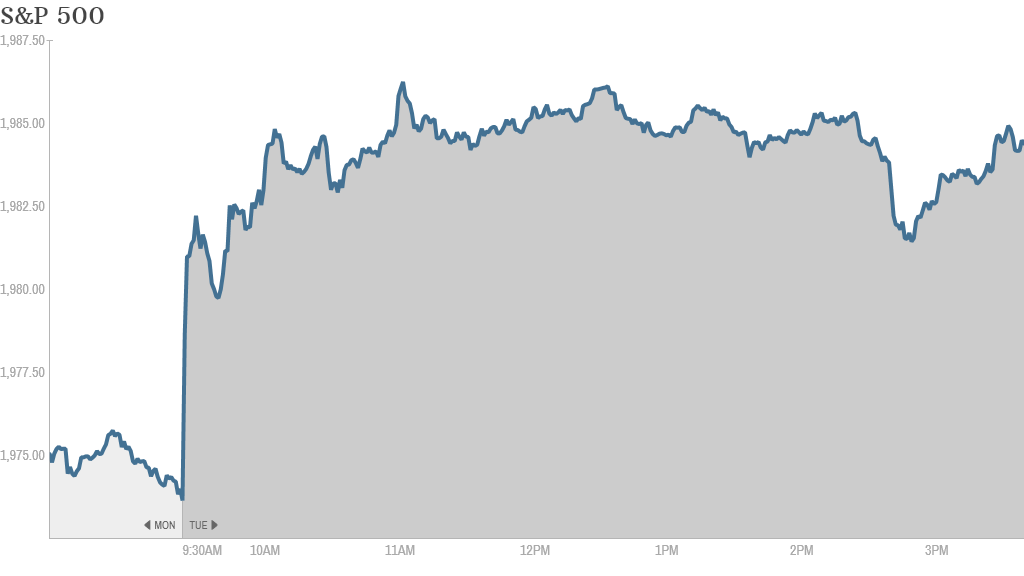

1. Stocks march ahead: It's hard to keep this market down. The S&P 500 hit another all time high Tuesday before pulling back slightly. It still gained half a percent for the day. The Dow rose 60 points and is within spitting distance of its record close, which occurred last week. The Nasdaq moved higher as well.

2. Major media and tech movers: Apple (AAPL) shares were flat in after-hours trading even though the tech giant reported profit and revenue that improved from a year ago. Sales were below analyst predictions and the revenue guidance was lower than expected as well. iPhone and Mac sales were strong points, while iPads and iPods didn't fare as well.

Microsoft (MSFT) reported earnings after the bell that came in below expectations, but sales topped forecasts as its commercial cloud revenue doubled. Bing ad revenue was another bright spot with 40% growth. Shares were down slightly after-hours.

Electronic Arts (EA)shares rallied in after-hours trading after the video game maker topped earnings estimates.

The internet is king for Comcast (CMCSA), which said in its second quarter earnings report Tuesday that a 15% increase in high speed internet users offset losses from so-called "cord cutters" who are dropping cable TV subscriptions. The stock moved higher on the news. So did shares of Time Warner Cable (TWC), which Comcast has an agreement to buy.

Part of the reason consumers are ditching traditional cable is due to companies like Netfli, (NFLX) which now boasts over 50 million members. Still, the stock dipped 5% Tuesday since the company said in its earnings report that U.S. streaming subscriptions were lower compared to the year earlier.

Verizon (VZ) also experienced an earnings bump, driven by strong revenues from its wireless and Fios segments. Shares were up modestly Tuesday.

3. Hungry for some earnings: Food and beverage stocks were on the move as some major restaurant chains released second quarter results.

Shares of Chipotle (CMG) skyrocketed 12% after the burrito maker posted earnings late Monday that surged from the year earlier despite higher menu prices.

But McDonald's (MCD) sank after the fast food giant reported second quarter revenue and profit that fell short of expectations due to lower sales in the U.S. and Europe.

Related: McDonald's: People aren't lovin' it anymore

Domino's (DPZ) stock delivered for Wall Street after the pizza delivery service said that earnings grew 17.5%, driven by strong same store sales domestically and internationally.

Investors also got earnings from Coca-Cola (KO) Tuesday to wash down all those restaurant results. But the stock fizzled after saying its earnings for the full year are expected to suffer from unfavorable exchange rates.

4. Bikes and diet supplements: Shares of Herbalife (HLF) jumped over 25% even though a major hedge fund manager held a press conference revealing what he found after a nearly two-year probe into the company's nutrition clubs.

Related: Hedge fund manager crying Herbalife wolf?

Pershing Square's Bill Ackman has repeatedly called the company a pyramid scheme. The stock has fallen around 14% this year, but it's still up big since Ackman's short selling campaign against the firm began in December 2012.

Meanwhile Harley Davidson (HOG) shares downshifted after the iconic motorcycle company beat earnings forecasts for the quarter but lowered its full year guidance for bike shipments.

5. Forget about geopolitics: A number of U.S. airlines suspended flights to Tel Aviv after a rocket from Hamas struck near Ben Gurion airport, but that didn't seem to spook investors, as Israel's flagship index, the TA-25, finished slightly higher.

European markets also notched out gains as tensions in Ukraine appeared to ease slightly.

After delays and setbacks, a train carrying the bodies of most of those who died in the MH17 plane crash began moving out of eastern Ukraine.

Still, EU officials are meeting Tuesday to discuss further sanctions against Russia in a bid to end its support for separatist rebels in Ukraine. Western leaders say the bulk of evidence suggests the rebels shot down the Malaysia Airlines plane. Russia's stock market, the MICEX, was up Tuesday, but is still down over 4.5% for the month.