There's plenty going on in the markets. Let's get straight to it.

Here are the five things you need to know before the opening bell rings in New York:

1. M&A winners and losers: Mergers - including one successful deal and a couple of others that evaporated - are dominating the news on Wall Street.

Walgreens (WAG)said it will acquire Alliance Boots, as expected, for $5.3 billion. Walgreens also said that it's keeping its headquarters in the U.S., which was not expected. The Illinois-based pharmacy chain had been mulling a tax-saving move to Europe. Shares in the company have taken an 11% dive in premarket trading.

Rupert Murdoch's company 21st Century Fox (FOX) has given up on pursuing a deal to buy Time Warner (TWX), which owns HBO, CNN and CNNMoney. Shares in Time Warner plunged by about 13% in premarket trading while shares in Fox jumped by about 7%. Time Warner shares surged in July when Murdoch's $80 billion bid first hit the headlines.

Both media conglomerates report quarterly results Wednesday. Time Warner reported ahead of the opening bell with better than expected earnings. Fox is reporting after the close.

A tie-up between Sprint (S) and T-Mobile US (TMUS) also seems to be off the table, according to the Wall Street Journal. Shares in both companies plunged in premarket trading. That could leave French telecom company Iliad as the frontrunner to buy T-Mobile. Iliad shares were down 4% in Paris.

2. Apple and Samsung call off patent war: Apple (AAPL) and Samsung have called a truce on all their non-U.S. patent disputes. Investors may react favorably to this latest development, though the tech giants are still pursuing litigation in the States.

Related: Fear & Greed Index still gripped by extreme fear

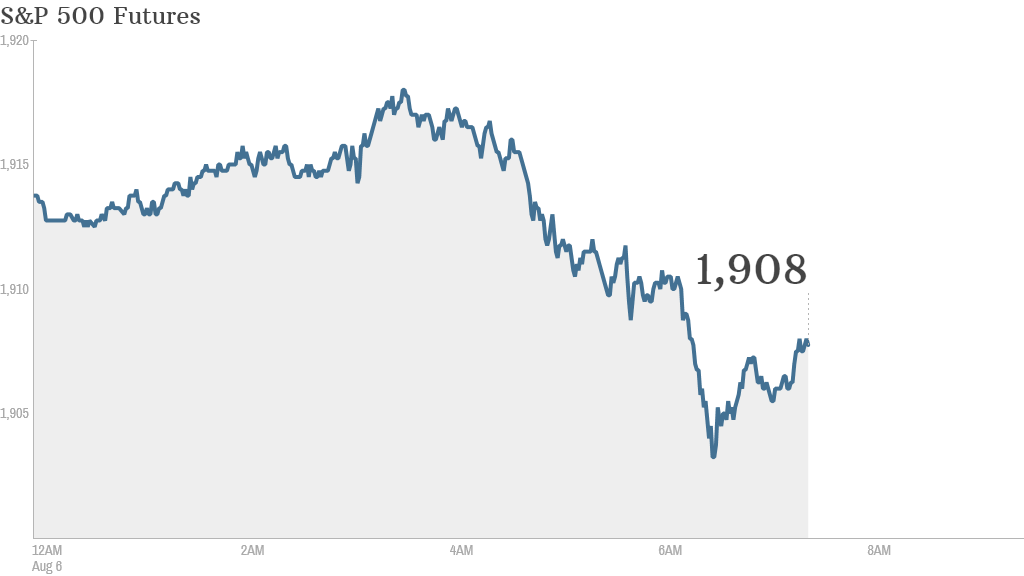

3. Premarket moves: U.S. stock futures lost their earlier gains and were falling ahead of the open.

All the major U.S. indices fell during the previous trading session, with much of the drop blamed on renewed concerns about geopolitical tensions with Russia.

4. International markets overview: European markets were all declining in early trading. Germany's Dax index fell 1.3% on new evidence that the Ukraine crisis is hurting its economy.

German factory orders fell 3.2% in June, against expectations for a small rise. The government blamed "geopolitical developments and risks" for the slump.

Meanwhile, nearly all Asian markets ended the day with losses. Japan's Nikkei fell 1% Wednesday -- leading the index to a full 3.1% drop over the last five trading days. China stocks were steadier, as they continue to bounce back from first half losses.

5. Earnings and economics: Various major U.S. companies are reporting earnings before the bell, including DISH Network (DISH), Mondelez International (MDLZ), Molson Coors (TAP) and Viacom (VIA).

Keurig Green Mountain (GMCR) is among the companies reporting after the close, alongside Fox.

On the economic front, the Census Bureau is releasing details on the U.S. trade balance at 8:30 a.m. ET.