If Pepto-Bismol and Emetrol sales aren't surging at drug stores in lower Manhattan these days, they should be. The stock market is off to a nausea-inducing start to 2015.

Stocks plunged Wednesday. The Dow was down nearly 350 points in midday trading before bouncing back a bit. But it still finished the day with a 187-point loss.

The reason for the sell-off? Investors were worried about a surprise drop in retail sales in December, weak results from megabank JPMorgan Chase (JPM) and a more bearish outlook about the global economy from the World Bank.

Related: 3 red flags causing the market to panic

Despite the big declines Wednesday, the Dow and S&P 500 are still not that far below their all-time highs. They are each just 4% off the records they hit in late December. That's still a long ways from a 10% correction.

Volatility has returned with a vengeance this January. The Dow has been moving up or down by at least 100 points nearly every day this year.

CNNMoney's Fear & Greed Index is showing signs of Extreme Fear again. And a volatility gauge known as the VIX (VIX), which is one of the components in our index, is up nearly 20% so far this year.

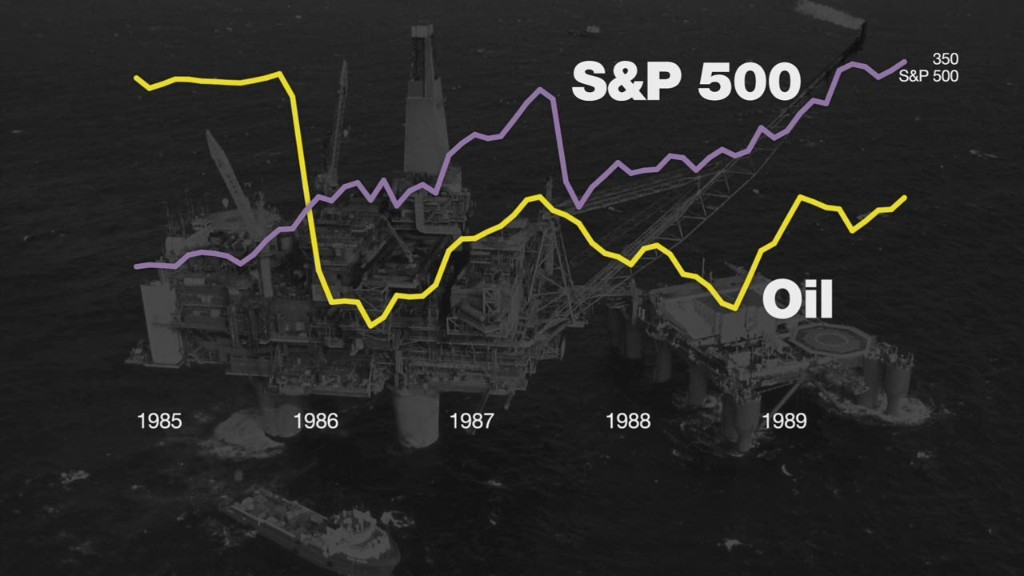

Oil prices actually stabilized on Wednesday. But the large drop in crude that started last fall and has continued into 2015 has definitely been one reason why traders have been rattled.

"It feels like we've gotten shot out of a cannon this year," said Bill Stone, chief investment strategist with PNC Asset Management Group. "People are worried about oil and looking for answers."

Still, cheap oil may not be a bad thing. Stone noted that one of the reasons December retail sales fell was because of how low gas prices plunged last month.

But the weakness in oil is raising concerns about the health of the global economy. The World Bank's new gross domestic product, or GDP, forecasts on Wednesday didn't help assuage any of those fears.

"The biggest issue is global growth and a worry about if or when it might hurt the U.S. economy," said David Joy, chief market strategist with Ameriprise Financial.

With that in mind, investors have been rushing to scoop up so-called safe haven assets like bonds and gold.

The yield on the U.S.10-Year Treasury fell below 1.8% Wednesday morning -- its lowest level since May 2013.

Related: Worried about stocks? Bonds look worse

Rates fall when investors are scooping up bonds. And Treasury bonds seem to be attractive now because the U.S. economy looks to be in much better shape than Europe and Japan.

Gold, which is often considered a hedge against inflation, deflation, geopolitical turmoil and all sorts of nasty things that can make investors scared, has been one of the hottest investments of this new year.

The SPDR Gold Shares (GLD) exchange-traded fund, which closely tracks the metal, is up 5%. And gold miners have done even better. The Market Vectors Gold Miners (GDX) ETF has soared 11%.

When will the madness end? The volatility is unlikely to end anytime soon. More companies will be releasing their latest earnings in the coming weeks.

If the 2015 outlooks from blue chips like Apple (AAPL), Coca-Cola (KO), General Electric (GE) and Caterpillar (CAT) are not as strong as investors are hoping for, that could lead to more market turmoil.

But the biggest driver of the market for the rest of the month may be Europe.

The European Central Bank holds an important policy meeting next week. It is expected to unveil some sort of bond buying program, a round of quantitative easing similar to the one that the Federal Reserve ended last year. But if the ECB's QE is not as big and bold as the market wants, that could be a problem.

Related: One more step closer to European QE

And just days after the ECB meeting, elections in Greece will be held. Their outcome may determine whether Greece stays in the eurozone or not. The euro currency has already plunged to multi-year lows. If Greece drops the euro, that has the potential to roil the global currency and stock markets even further.

In other words, buckle up. It's going to be a bumpy ride. There's a lot to worry about.

"I feel like a juggler on the old Ed Sullivan Show. It's hard to figure out what to catch without dropping something else," Joy said.