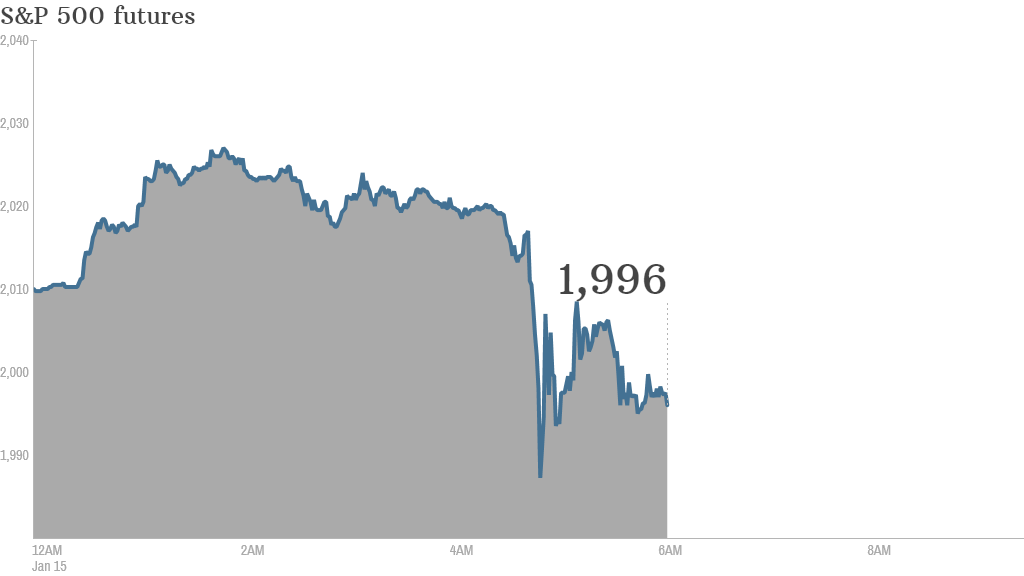

Buckle up. It's going to be a choppy session for markets.

U.S. stock futures and European markets gave up early gains to trade lower after Switzerland stunned markets by allowing its currency to trade freely against the euro, and taking interest rates deep into negative territory.

Here are the five things you need to know before the opening bell rings in New York:

1. Swiss stun markets: The Swiss central bank removed its exchange rate ceiling of 1.2 Swiss francs to the euro, a cap introduced in 2011 during the eurozone crisis to limit the flow of cash into the traditional safe-haven economy.

The franc surged against the euro, U.S. dollar and U.K. pound on the news, despite a simultaneous announcement that key Swiss interest rates were being cut to minus 0.75%.

"This exceptional and temporary measure protected the Swiss economy from serious harm," the central bank said in a statement. "While the Swiss franc is still high, the overvaluation has decreased as a whole since the introduction of the minimum exchange rate. The economy was able to take advantage of this phase to adjust to the new situation."

Another down day Thursday would be the fifth in a row for markets. On Wednesday, the Dow Jones industrial average lost 187 points, while the S&P 500 fell 0.6% and the Nasdaq closed 0.5% lower.

2. Earnings and economics: The market mood could swing again based on the latest set of earnings.

Bank of America (BAC), Citigroup (C) and BlackRock (BLK) will report quarterly earnings before the opening bell. Intel (INTC) will report results after the close.

On the economic front, the U.S. government will report weekly jobless claims at 8:30 a.m. ET. Official data on producer prices in December will also come out at the same time.

Related: 3 flags causing the market to panic

3. Bankruptcies: Failing companies may also grab attention Thursday. RadioShack (RSH) is reportedly preparing to file for bankruptcy. The filing could come during the first week of February, according to the Wall Street Journal. RadioShack declined to comment.

Meanwhile, the operating unit of Caesars Entertainment (CZR), the owner of Caesars Palace casinos, has filed for Chapter 11 bankruptcy.

Shares in Caesars have dropped by nearly 20% since the start of this month.

4. Smartphone makers take the stage: Watch for volatility in BlackBerry (BBRY) shares Thursday. The stock soared 30% Wednesday based on a report of a takeover bid from Samsung, and then fell back as much as 16% in extended trading after BlackBerry issued a denial.

Chinese smartphone maker Xiaomi -- dubbed the Apple (AAPL) of China -- launched what it hopes will be an iPhone killer in Beijing.

5. India cuts rates: The Reserve Bank of India unexpectedly cut key lending rates on Thursday in an effort to boost growth in the Asia's third-largest economy.

The central bank was not scheduled to issue a rate decision, and the move took economists and analysts by surprise. The Mumbai Sensex index shot up by 3%.