Welcome to Tuesday!

Here are the six things you need to know before the opening bell rings in New York:

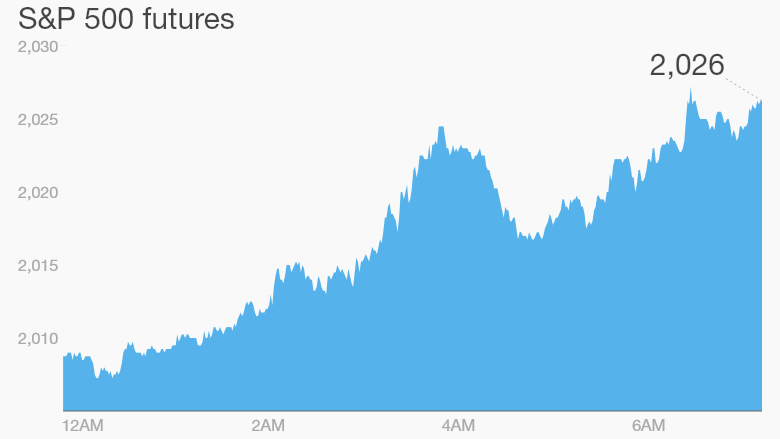

1. Oil lifts markets: Crude oil is up by about 3% to roughly $51 per barrel, lending support to U.S. stock futures.

A key mover is Transocean (RIG), which is gaining 4% in premarket trade. Other energy companies are also moving up.

In London, shares in BP (BP) are rising by about 2.5% after the company posted a quarterly loss that was not as bad as expected. The company also announced it was slashing spending plans, just like competitors including Royal Dutch Shell (RDSB).

Falling oil prices, which have plunged from over $100 per barrel, have hit profits and major producers have responded by reining in their capital investment.

Related: The World's Top Oil Producers

2. Retail wrangling -- RadioShack, Staples, Office Depot: RadioShack's (RSH) financial problems worsened overnight after the New York Stock Exchange suspended trading of its shares, and a key lender said it defaulted on a financial lifeline.

RadioShack shares lost 90% of their value in the last 12 month as investors worried that bankruptcy loomed.

On the flip side of the coin, shares in Staples (SPLS) are rising by about 11% premarket after the Wall Street Journal reported that the company is in advanced talks about a deal with Office Depot (ODP).

Investors have been hoping that the two companies would combine operations. Both firms have been struggling with falling demand for office supplies.

3. Markets cheer Greek proposals: Most European markets are rising by over 1%, and the main indexes in Spain and Italy are up by roughly 2%.

Investors were encouraged by reports that the Greek government is adopting a more measured approach to its debt standoff with Europe.

The main Greek index is up by 9% Tuesday, nearly erasing all the heavy losses endured since the start of the year.

4. Australia lowers rates: The Australian central bank is cutting its key interest rate by 25 basis points to a record low of 2.25%.

The Reserve Bank of Australia said its decision is based on expectations for low growth, both in Australia and globally, and weak domestic demand.

Australia's main stock market index jumped by 1.4%.

Across the rest of Asia, markets were mixed.

5. Earnings: The New York Times (NYT) and UPS (UPS) will report earnings before the opening bell.

Chipotle Mexican Grill (CMG), Aflac (AFL) and Disney (DIS) will report after the close.

6. Monday market recap: Over the previous trading session, the Dow Jones industrial average gained 196 points, while the S&P 500 jumped 1.3% and the Nasdaq rose 0.9%.