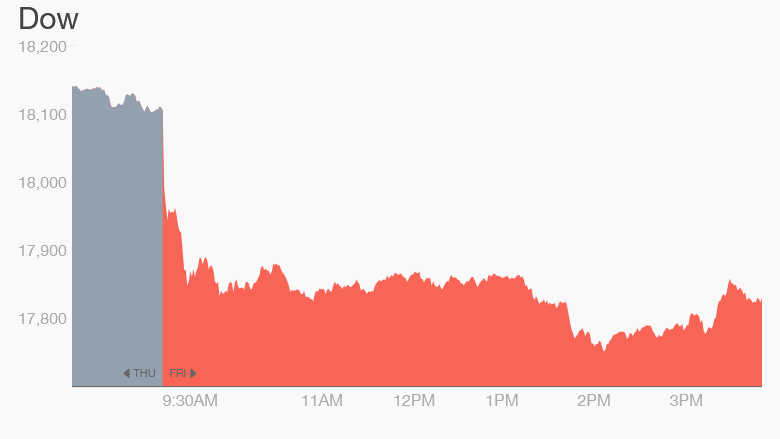

Investors probably wish the weekend had started early. Stock markets around the world are ugly Friday.

The Dow tumbled nearly 280 points. The tech-heavy Nasdaq finished the day down 1.5%. You know it's bad when the best performing sector in the S&P 500 is utilities -- the classic defensive sector that traders run to in times of trouble.

There are two triggers:

1) China. There's been plenty of talk about a bubble in Chinese stocks. Today government regulators took steps to try to crack down on so-called margin trading. They are also allowing more short-selling where people can bet that stocks will fall. That didn't go down well with investors who began to question if a market that is up over 75% since October can sustain this pace, especially as China's economy slows down.

2) Greece. It's an ongoing saga: Will Greece pay its debt or won't it? But it seems to rattle markets every few days and Friday is one of those tense moments.

On top of the global gut punches, Bloomberg trading terminals went down Friday morning just as the trading day started in London. That's akin to Wi-fi no longer working at your home or business. Those terminals are critical to many traders. While they were back up by 7am ET, it certainly didn't help Wall Street's mood.

Related: Bubble trouble: China's stock market looks too hot

American investors appear to be merely following the rest of the world into a dive. Europe's main STOXX index fell 1.6%, Germany's Dax ended down 2.6%. Many of Asia's indexes closed down as well.

"Greece has worked its way back into the headlines again this week, and whenever that happens, the short-term impact on global equity markets is never good," Bespoke research wrote to clients this morning. Bespoke noted that Credit Default Swaps now suggest there's a 75% chance Greece will default on its debt.

Related: Greece running out of time to avoid collapse

But here's the catch: Long-term investors should remember that stocks are still very close to their all-time highs. Even at it lowest point Friday, the Dow was less than 3% from the record peak it hit in early March. The S&P 500 is under 2% from its high. So it's hardly time for panic button yet.

The fundamentals really haven't shifted.

Related: What happened to the Bloomberg terminals?

Three major themes have been driving the markets lately: oil, the strong dollar and the impending Federal Reserve rate hike. If anything, all of those "fears" have abated in recent days.

Oil had one if its best rallies in years this week. While oil is still low -- under $60 a barrel -- it no longer looks like it's going to crash to the $40 or even $30 prices some were warning about earlier this year.

Similarly, the dollar is also holding steady. Yes, it's a big headwind for corporate earnings, but companies that have reported their first quarter so far like Goldman Sachs (GS) and JP Morgan (JPM) have done all right despite the dollar.

Related: $5.9 billion profit for JPMorgan Chase

Finally, all signs point to the Fed likely waiting to raise interest rates off their historic lows until September. For awhile investors and economists predicted June would be the big month, but now it's looking like September.

"Stocks have been on a great run lately filled with healthy sector rotation," J.C. Parets, founder of Eagle Bay Capital, told CNNMoney. "In the real world a 1.4% move is very normal... [it's] not a big deal."

The bottom line: CNNMoney's Fear & Greed Index, for example, is a good gauge of momentum. It is still in neutral mode even after the Friday dive.

Brad McMillan, chief investment officer for Commonwealth Financial Network, is still optimistic: "I suspect the market is poised to continue to rise overall, but it will take awhile for the trends to become clear enough for that to happen. In the meantime, we can expect the kind of market behavior we've seen recently to continue."

So take a deep breath and remember there is still money to be made. Just look at Netflix (NFLX). The stock began trading on Wall Street in 2002 at a mere $9 a share. On Thursday, it surged above $500 for the first time ever, and it's one of the few big stocks up again today.