Get ready for a tsunami of earnings Thursday.

Here are the five things you need to know before the opening bell rings in New York:

1. Endless earnings: PepsiCo (PEP), Domino's Pizza (DPUKY), Dunkin' Brands (DNKN), Dr. Pepper Snapple (DPS), Hershey (HSY), P&G (PG), General Motors (GM), United Continental (UAL) and Southwest Air (LUV) are just a few of the big names reporting ahead of the open.

Amazon (AMZN), Google (GOOGL), Microsoft (MSFT), and Starbucks (SBUX) will report after the close.

2. Potential market movers: Shares in eBay (EBAY) are expected to jump at the open after the company reported earnings that beat Wall Street's expectations.

On the flip side of the coin, shares in Facebook (FB), Qualcomm (QCOM), Las Vegas Sands (LVS) and Texas Instruments (TXN) all fell in extended trading as investors expressed disappointment with their latest quarterly results.

Time Warner Cable (TWC) stock is off by about 3% premarket as investors expect its planned $45 billion merger with Comcast (CCV) will not go through.

Ericsson (ERIC) shares are falling by about 13% in European trading after the telecom equipment company reported a sharp fall in profits.

Shares in Deutsche Bank (DB) are edging lower after authorities in the U.S. and U.K. announced a $2.5 billion fine against the bank for Libor manipulation. The bank paid more than €700 million in 2013 to settle similar European charges.

Shares in Brazilian oil giant Petrobras (PBR) could take a dive after the firm announced a $7.2 billion annual loss. The news follows an investigation into a multimillion-dollar kickback scheme at the state-controlled company. Petrobras hasn't reported earnings since last August because auditors refused to sign off the figures.

3. Economics: The U.S. Department of Labor will report weekly jobless claims at 8:30 a.m.

At 10 a.m., the Census Bureau will release data on new home sales in March.

Taking a look abroad, new data shows manufacturers aren't living up to expectations in Europe and China. The HSBC flash PMI index that tracks manufacturing activity in China fell to a 12-month low on Thursday, indicating continued weakness in the world's second largest economy.

In the eurozone, a similar PMI index from Markit showed eurozone manufacturing is growing, but at a pace that was below expectations.

"Despite the weakness of the [euro] currency, the externally sensitive manufacturing sector continues to struggle against a backdrop of weak global trade," said Ken Wattret, an economist at BNP Paribas.

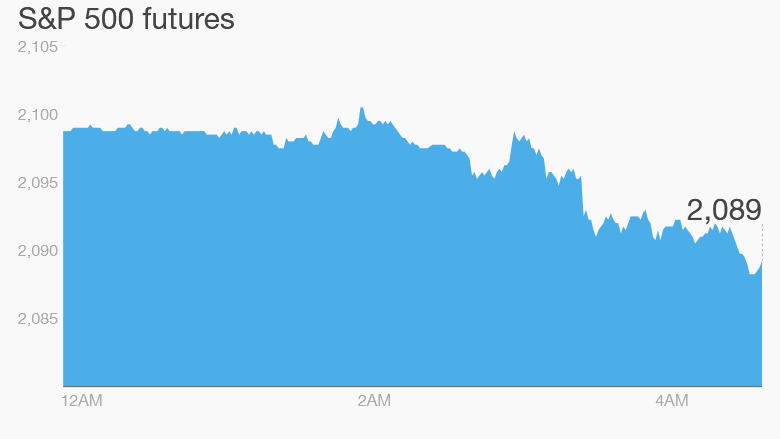

4. Stock market overview: U.S. stock futures are dipping down ahead of the open.

Many key European indexes are declining about about 1% in early trading.

Asian markets ended the day with mixed results.

5. Wednesday market recap: Stocks closed with gains Wednesday.

The Dow Jones industrial average gained 89 points, while the S&P 500 rose 0.5% and the Nasdaq moved up 0.4%.

-- CNN's Shasta Darlington contributed to this report.