Welcome to Wednesday.

The mood has improved since Tuesday's drop.

Here are five things you need to know before the opening bell rings in New York:

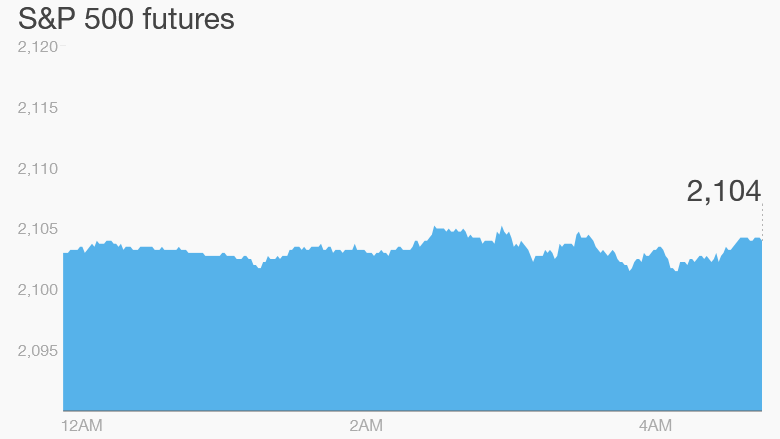

1. Stock market overview: U.S. stock futures are holding steady following a Tuesday pullback. Investors seem to have been concerned about an upcoming interest rate hike from the Federal Reserve.

On Tuesday, the Dow Jones industrial average, S&P 500 and Nasdaq all declined by about 1%. Still, stocks are not far from their all-time highs.

In Europe, all the main indexes are pushing up in early trading. Asian markets ended with mixed results.

2. Currency focus: The International Monetary Fund has declared the Chinese yuan is "no longer undervalued," after spending years criticizing China for keeping its currency from strengthening too much against the U.S. dollar.

China's yuan, also called the renminbi, has risen about 0.5% against the U.S. dollar in the last year.

The dollar is a bit weaker Wednesday versus a range of other currencies. The euro is strengthening.

3. Earnings: DSW (DSW), Michael Kors (KORS) and Tiffany & Co (TIF) are reporting ahead of the open.

Costco (COST) will report after the close.

4. Smokin' stocks: Shares in Imperial Tobacco Group (ITYBY) are edging up by about 1.5% in London after the company announced it had received regulatory approval to acquire some cigarette and e-cigarette brands from Reynolds American (RAI) and Lorillard (LO).

"The announcement puts an end to over 10 months of uncertainty about whether the deal would be signed off," said Mike van Dulken, head of research at Accendo Markets in the U.K.

This comes as BrandZ publishes an annual ranking showing that the Marlboro cigarette brand remains one of the most valuable in the world, worth more even than the Facebook (FB) brand. Marlboro cigarettes are sold by Altria (MO) in the U.S. and Philip Morris International (PM) overseas.

Related: The 10 most valuable global brands

5. Potent politics: Investors will be watching political moves in Europe as G7 finance ministers begin a three-day meeting in Dresden, Germany.

"Greece is likely to feature prominently in the discussions, and traders will keep a close eye on headlines emerging from the sit-down for direction cues," said Ilya Spivak, a currency analyst at DailyFX.

Investors in the U.K. have also been watching "The Queen's Speech," where Queen Elizabeth II outlines the new government's legislative agenda.