It's the last day of July and if stocks hold steady Friday, all three U.S. indexes will close out a bumpy month with gains.

So far, so good.

Here are the five things you need to know before the opening bell rings in New York:

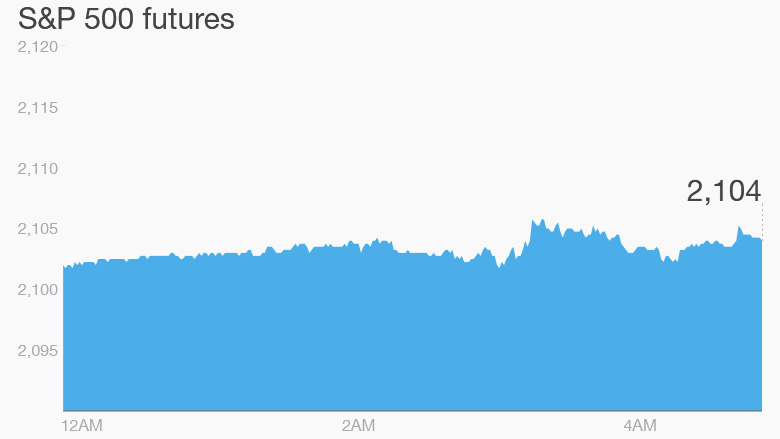

1. Market overview: U.S. stock futures are not making any major moves ahead of the open.

The Dow Jones industrial average has added 0.7% this month. The S&P 500 and Nasdaq have both posted healthier gains of 2.2% and 2.9%, respectively.

European markets are mixed in early trading.

Most Asian markets ended with gains, except for China where the Shanghai Composite dipped by 1.1% and the Shenzhen index edged down by 0.8%. Chinese markets have stabilized a bit after crashing earlier this month. The Shanghai index lost 14% in July.

2. Major movers -- LinkedIn, Expedia, Hanesbrands: Shares in LinkedIn (LNKD) are highly volatile premarket as investors react to the group's earnings released Thursday. At first, shares shot up, but then pushed deep into negative territory as investors grew concerned about future revenue growth.

Shares in Expedia (EXPE) are rising by about 8% premarket after releasing better-than-expected quarterly results.

Shares in Hanesbrands (HBI) are tumbling by about 8.5% in reaction to its new earnings report from Thursday afternoon.

3. More earnings: Earnings continue to roll in Friday.

Several major oil companies including Chevron (CVX), Exxon Mobil (XOM) and Phillips 66 (PSX) are expected to release results before the market opens.

Honda (HMC) reported results this morning that beat expectations. Shares are up about 1.5% in Tokyo. Airbus (EADSF) shares are also rising by 3% in Paris after reporting earnings Friday morning.

4. Watch commodities and currencies: Crude oil is skidding lower again -- down nearly 2% -- and currency markets are volatile.

"The last trading day of the month [brings the] risk of choppier than normal trading as institutional investors re-balance portfolios and funds adjust to fit around month end performance statistics," wrote Simon Smith, chief economist at FxPro, in a Friday note.

In early trading, the Aussie dollar and Canadian dollar were weaker, while the Swiss franc was firmer against most major currencies.

5. Economics: At 8:30 a.m. ET, the U.S. government will report whether workers' paychecks grew during the second quarter. For the first quarter, the Employment Cost Index showed wages and salaries were up 0.7%, slightly better than the 0.6% growth in the final quarter of 2014.

A final reading of July's Consumer Sentiment Index is also expected at 10 a.m. from the University of Michigan. Preliminary numbers showed consumers were slightly less tempted to spend money this month.