Welcome to the final trading day of October.

The CNNMoney Fear & Greed index shows investor sentiment has recently turned greedy. Traders are expecting treats instead of tricks.

Here are the five things you need to know before the opening bell rings in New York:

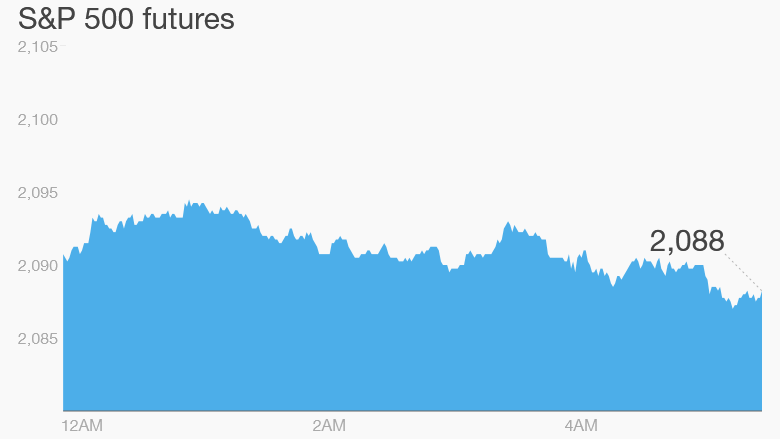

1. Stock market overview: U.S. futures are solid ahead of the open, indicating stocks may edge higher when the trading bell rings.

European markets are mostly positive in early trading, though the gains are small.

Asian markets generally closed the week with some losses. China's announcement that it would abolish its "one-child" policy didn't give the markets a lift. The change isn't expected to help China's faltering economy for years.

2. Market movers -- First Solar, Expedia, Genworth: Investors in First Solar (FSLR) are in for a treat after the solar panel manufacturer released better-than-expected earnings on Thursday evening. Shares are rising by about 11% premarket.

Expedia (EXPE) stock is also rising by about 6% in extended trading after the travel website company unveiled earnings that beat Wall Street forecasts.

But investors were unimpressed with the latest quarterly report from financial services company Genworth (GNW). Shares dropped by about 11% in extended trading.

3. Earnings: Noteworthy companies reporting this morning include Exxon Mobil (XOM), Phillips 66 (PSX), CVS Health (CVS) and Chevron (CVX)

Beer brewing giant Anheuser-Busch InBev (AHBIF) is also posting quarterly results and could provide an update about its planned takeover of SABMiller (SBMRY).

4. Economics: Japan's central bank decided to hold its fire on more economic stimulus after a policy meeting wrapped up Friday. Some experts had expected the government to act, as the latest figures showed the economy shrank by 0.3% in the second quarter.

In the U.S., the Bureau of Economic Analysis will post its September report on personal income and spending at 8:30 a.m. ET.

The University of Michigan will give a final update to October's consumer sentiment index at 10 a.m.

5. Thursday market recap: It was a big day for M&A and earnings on Thursday.

Investors got excited after Allergan (AGN) and Pfizer (PFE) confirmed they were in friendly talks about a potential business combination. If the deal goes through, it would create the biggest pharmaceutical company in the world.

However, the main indexes didn't make any significant moves.

The Dow Jones industrial average dipped by 0.1%, the Nasdaq dropped 0.4% and the S&P 500 was relatively flat.