There's an expectant, nervous mood on Wall Street as top policymakers at the Federal Reserve come together for a historic two-day meeting.

Nearly everyone is expecting the Fed to raise its key interest rate tomorrow at the close of the meeting.

Here are the four things you need to know before the opening bell rings in New York:

1. Hike, rattle and roll: The Federal Reserve is widely expected to hike rates Wednesday for the first time in nearly a decade.

The Fed slashed interest rates to just above zero in December 2008 to stimulate the economy and boost the housing market during the Great Recession.

A rate hike "will be a testament...to how far our economy has come in recovering from the effects of the financial crisis and the Great Recession," Fed Chair Janet Yellen said in a recent speech.

But an interest rate rise is never a 100% sure thing.

"The Fed does have the ability to surprise the market and one should never rule out ... [the] possibility that they can leave the interest rate unchanged," said Naeem Aslam, chief market analyst at Ava Capital Markets.

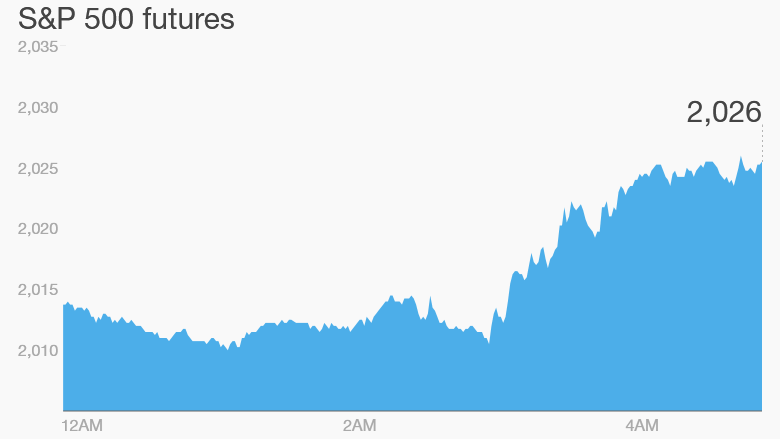

2. Stock market overview: U.S. stock futures are rising ahead of the open and nearly all European markets are jumping by about 1% to 2% in early trading.

Shares in European automakers like BMW (BAMXY), Daimler (DDAIY) and Fiat Chrysler (FCAM) are rallying by about 3% after official data shows car sales across the European Union surged by nearly 14% in November compared to the previous year. This marks the 27th consecutive month of sales growth.

Asian markets ended the day with mixed results.

Looking back to Monday, the Dow Jones industrial average added 0.6%, the S&P 500 rose 0.5% and the Nasdaq dipped by 0.4%.

Related: Fed hike shouldn't kill stocks

3. Oil prices stabilize: Crude oil futures are steady Tuesday and trading around $36.50 per barrel.

Prices slid to $34.53 a barrel on Monday -- the lowest level since February 2009.

The drop was fueled by concerns about a surge in Iranian oil production as the world tries to cope with oversupply in the market.

4. Economics: The U.S. federal government will update its inflation data for November at 8:30 a.m. ET. Inflation data in October was in line with expectations, showing prices increased about 0.2%.

Over in Australia, the government lowered its 2015-2016 economic growth forecast, down to 2.5% from 2.75%. It also forecast higher debt and deficits.

In a statement, treasurer Scott Morrison blamed the deteriorating budget on falling commodity prices and weaker global growth, among other things.