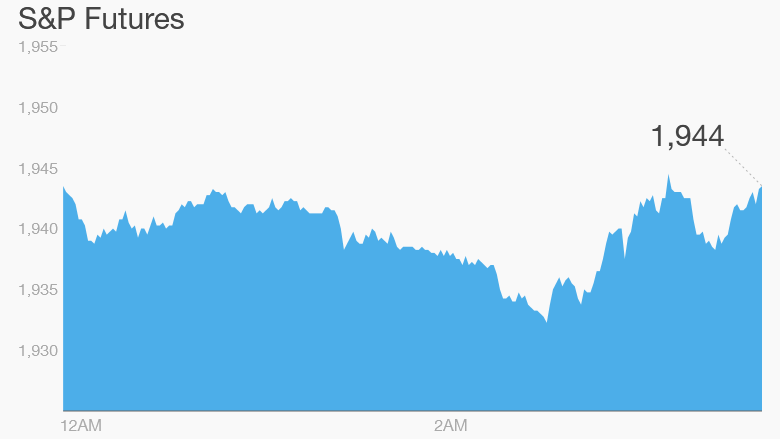

A day after being told by an RBS analyst to "sell everything," someone is buying stocks and oil. Crude futures are up, European markets have jumped at the open and U.S. futures are higher by around 1%. Better than expected export trade data from China has given investors some respite after a terrible start to the year.

Here are the four things you need to know before the opening bell rings in New York:

1. Oil: Crude futures are bubbling up around 1% to above $31 a barrel after oil briefly sank below $30 for the first time since December 2003. The selling on Tuesday left crude down 19% this year alone, and 72% from its June 2014 peak of almost $108. Traders will closely watch a weekly update on U.S. crude inventories that is due at 10:30 am ET.

2. Stock market movers -- Metlife, Yum Brands, Ford, BP, VW: Metlife (MET) shares surged more than 7% Tuesday night after The Wall Street Journal reported it's planning to separate or sell its U.S. life insurance operations. KFC and Taco Bell owner Yum Brands (YUM) was trading 3% higher premarket, while Ford (F) shares dropped 3%.

BP (BP) shares are up 2.5% a day after it slashed another 4,000 jobs amid low oil prices.

Volkswagen (VLKPY) shares are up more than 2.5% despite ongoing confusion surrounding the emissions scandal and whether the auto giant "lied" to regulators.

3. International markets overview: European markets are up in early trading, with Paris jumping nearly 1.5% at the start. Asian markets ended mixed with the Nikkei closing up nearly 3% while Shanghai fell 2.4%.

4. Tuesday market recap: The Dow Jones industrial average was up 0.7%, while the S&P 500 gained 0.8% and the Nasdaq added 1%.