It's a rough start to the last day of the trading week.

Oil is sinking once again, taking mining and energy shares with it. Chinese markets are falling, and Europe is firmly in the red.

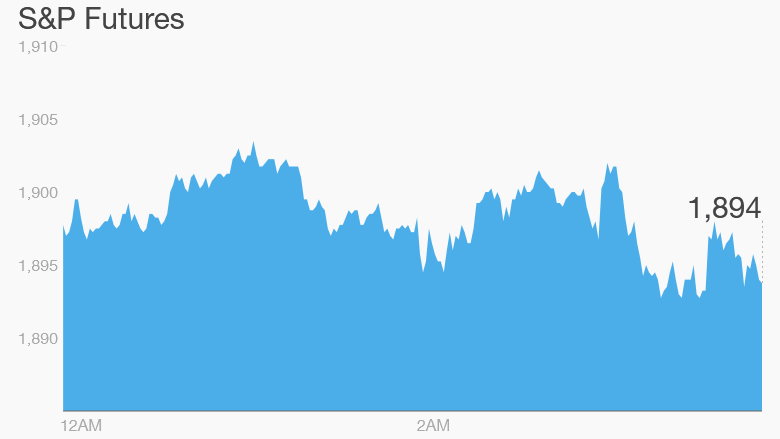

Little wonder U.S. stock futures are down more than 1%.

Here are the six things you need to know before the opening bell.

1. China bear: The Shanghai Composite closed down 3.6% Friday, more than 20% below its recent high. Persistent worries about China's cooling economy and sinking currency have pushed the index into bear market territory.

2. Oil below $30: Crude oil futures remain as volatile as ever, and are down nearly 5% -- crashing below $30 in morning trading. Shares in BHP Billiton (BBL) fell 5% at the London open after it took a $7 billion write down on its onshore U.S. oil assets.

3. More stock market movers: Anglo American, GE, Fiat Chrysler: Continuing the theme of battered commodities, Anglo American (AAUKF) is down another 8% in early trading. Shares of natural gas company ONEOK (OKE) plunged nearly 6% after hours.

Fiat Chrysler (FCAU) shares are up 1% in Milan after heavy falls Thursday when it confirmed it is being sued by a U.S. dealer over claims the automaker tried to inflate sales figures. Fiat Chrysler flatly denies the allegations.

GE (GE) has agreed to sell its appliance business to China's Haier for $5.4 billion.

4. Earnings: Wells Fargo (WFC), Citigroup (C), U.S. Bancorp (USB), PNC (PNC), and BlackRock (BLK) are expected ahead of the open.

5. Economics: At 8:30 am ET, a U.S. retail sales report for December 2015 is due from the Census Bureau, and the Bureau of Labor Statistics will have December's producer price index.

Also at 8:30 am, the Federal Reserve Bank of New York will post the Empire Manufacturing Survey for January. The Federal Reserve's report on industrial production and capacity utilization is expected at 9:15 am. Then, at 10 am, the University of Michigan will update its consumer sentiment index for January.

6. Markets overview: European markets are all in the red in early trading, while Asian markets also ended down, with Hong Kong off by 1.5% and the Nikkei down 0.5%. On Thursday, the Dow Jones industrial average gained 1.4%, while the S&P 500 added 1.7% and the Nasdaq rallied 2%.