It's Monday and stocks around the world are rising.

But there are still pockets of fear lurking in the markets.

Here are the six things you need to know before the opening bell rings in New York:

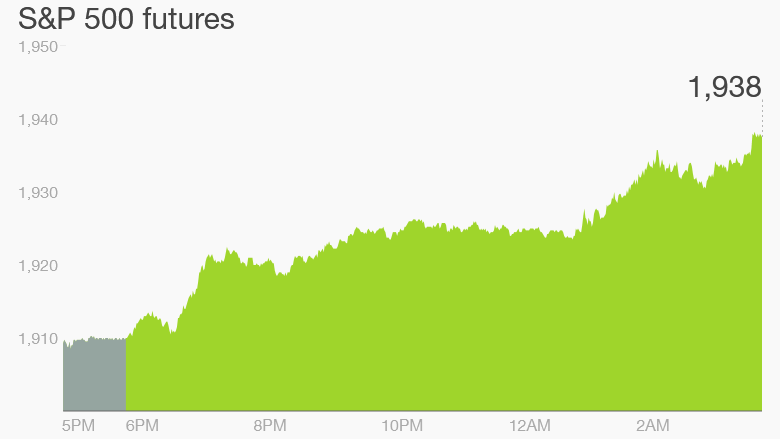

1. Stock market overview: U.S. stock futures are rising by about 1% and European markets are experiencing broad based gains in early trading.

Asian markets rallied during the day. Nearly all of the key Asian indexes closed in positive territory.

Investors are feeling confident as prices for oil and industrial metals rise.

Crude oil futures are trading just above $32.50 per barrel, which is roughly the highest level they've seen since the start of February.

Prices for aluminum, zinc and iron ore are also rising, which is helping to lift shares of miners such as Anglo American (AAUKF) and Rio Tinto (RIO).

2. Brexit fears hit pound: British Prime Minister David Cameron has set June 23 as the date for a historic referendum when voters will decide whether they want the U.K. to exit the European Union or stay put.

The pound took a major hit after London's popular mayor Boris Johnson voiced his support for an exit, aka Brexit. The pound is falling by 1% to 2% versus all other major currencies.

The U.K. is one of the richest members of the European Union. Billions in trade ties are at risk if Britons vote to leave and many big businesses are against the move. Pro-Brexit campaigners want to leave the EU so the country can regain control of lawmaking and limit migration.

3. Stock market mover -- HSBC: Shares in HSBC (HSBC) are dropping in London trading after the global bank reported its latest set of quarterly results.

Profit in 2015 declined versus 2014 because of higher costs and charges. The bank also revealed the Securities and Exchange Commission is investigating its hiring practices in Asia.

The SEC is working to understand if the bank gave jobs to friends and family of government officials, and in doing so, violated laws prohibiting bribery of foreign officials.

4. Tech talk: The Mobile World Congress is underway in Barcelona and leading tech companies are previewing their newest gadgets.

Samsung showed off its Galaxy S smartphones on Sunday. The S7 and S7 Edge are dust- and water-resistant.

Investors are watching to see which products capture the hearts and minds of consumers.

5. Earnings: The earnings flow has slowed to a trickle.

Pharma giant Allergan (AGN) is among the few companies reporting results before the opening bell.

Fitbit (FIT) is reporting after the close.

6. Weekly market recap: The Dow Jones industrial average posted its best weekly gain of 2016, up over 400 points last week. The Nasdaq and S&P 500 also had their best week of the year. The gains were especially strong as the start of the week.