It's shaping up to be a feel-good Friday.

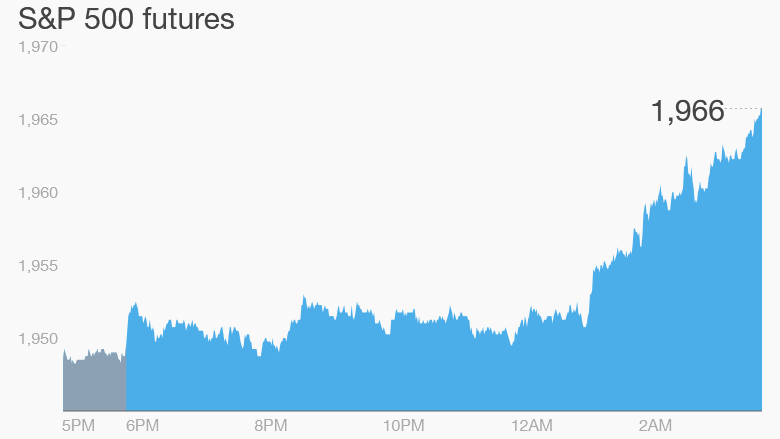

U.S. stock futures are pointing up and nearly all global markets are posting strong gains.

Here are the six things you need to know before the opening bell rings in New York:

1. Calm in China: Chinese stock markets were calm Friday following a sharp, unexpected drop on Thursday.

Investors may have been placated by comments from the head of China's central bank, Zhou Xiaochuan, who said the central bank still has the ability and tools to support the nation's economy.

His remarks, reported by local media, came as G20 finance ministers and central bankers began a two-day meeting.

2. Stock market losers -- Weight Watchers, RBS, Sharp: Shares in Weight Watchers (WTW) may come under pressure after the company reported worse-than-expected earnings. Weight Watchers has been an incredibly volatile stock since Oprah Winfrey took a 10% stake in the company back in October.

Shares in Royal Bank of Scotland (RBS) are falling in London after the bank reported a £2 billion ($2.8 billion) loss for the year, which was an improvement upon 2014 when the bank lost £3.5 billion ($4.9 billion).

And shares in struggling Japanese electronics firm Sharp (SHCAY) took another 11% fall Friday as investors worry that its planned takeover by Taiwan's Foxconn will fall apart.

3. Stock market winners -- Baidu, Kraft Heinz: Shares in Baidu (BIDU) are set to surge Friday as investors cheer its latest quarterly results. Shares in Kraft Heinz (KHC) are also set to rise based on an earnings beat.

4. Earnings: Companies including Magna (MGA), Hilton Hotels (HLT), Sotheby's (BID) and Foot Locker (FL) are due to report ahead of the open.

After the close, Warren Buffett's Berkshire Hathaway (BRKB) will release its fourth quarter results. The firm's annual report, along with a yearly shareholder note from Buffett, will be released around 8 a.m. ET on Saturday. Buffett's annual letter is a favorite among investment buffs.

5. Economics: The U.S. Bureau of Economic Analysis will release its latest GDP data at 8:30 a.m. ET. It will also issue a monthly personal income and spending report at the same time.

The University of Michigan will post its consumer sentiment index for February at 10 a.m.

6. Weekly market recap: It was a rocky week in the markets but overall stocks pushed higher.

On Thursday, the Dow Jones industrial average gained 1.3%, the S&P 500 grew 1.1% and the Nasdaq added 0.9%.