Oscar party-goers may be feeling a bit hungover this morning. Apparently, investors have woken up with sore heads too.

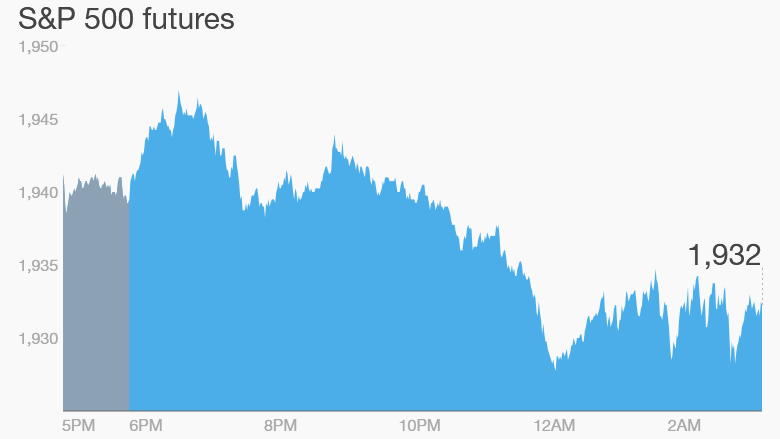

U.S. stock futures are sinking and nearly all international markets are in the red.

Here are the four things you need to know before the opening bell rings in New York:

1. February finale: It's the final trading day of February and if stocks take a significant dip, this could mark the third consecutive month of losses in the markets.

As it stands now, the Dow Jones industrial average and S&P 500 are in positive territory for the month, but not by much. The Nasdaq is down by 0.5% for February.

February has proven to be a volatile time in the markets following a sharp January sell-off.

2. Potential market mover -- Berkshire Hathaway: Shares in Warren Buffett's Berkshire Hathaway (BRKA) could be on the move after the company reported its annual earnings over the weekend.

Berkshire Hathaway A shares (BRKA) and B shares (BRKB) have declined by about 11% over the past 12 months.

3. Earnings: Taser (TASR) and Lumber Liquidators (LL) are reporting results ahead of the open. The embattled pharmaceutical firm Valeant (VRX) is also releasing results in the morning after announcing its CEO has returned from medical leave.

After the close, footwear firm Crocs (CROX) and insurance company MBIA (MBI) will release quarterly earnings.

4. Eyes on China, Iran and India: China has taken another step to boost its slowing economy by cutting the amount of cash banks must hold in reserve. The reserve ratio requirement will drop by 0.5 percentage points from March 1, the central bank said Monday.

International investors are also watching developments in Iran following a weekend election. Early results indicate voters favored reformists and supporters of President Hassan Rouhani. The country signed a landmark nuclear deal last year that limited the nation's nuclear program in exchange for sanctions relief.

A senior Iranian official told CNN the country was pushing ahead with plans to increase oil production by one million barrels per day, despite a global supply glut.

India is also in the spotlight as the country reveals its latest budget, which outlines economic and political priorities for the 2016-2017 fiscal year.