It's March and investors seem to have a spring in their step!

Here are the five things you need to know before the opening bell rings in New York:

1. Eyes on the exchanges: New York Stock Exchange operator Intercontinental Exchange (ICE) is considering making a bid for the London Stock Exchange (LDNXF).

This comes a week after German market operator Deutsche Boerse (DBOEF) announced plans to acquire the London Stock Exchange, though the agreed "merger of equals" still needs shareholder and regulatory approval.

Shares in the London exchange are surging by about 8% Tuesday. The London Stock Exchange is now worth about £10 billion ($14 billion) -- up about 27% since Deutsche Boerse announced its offer in late February.

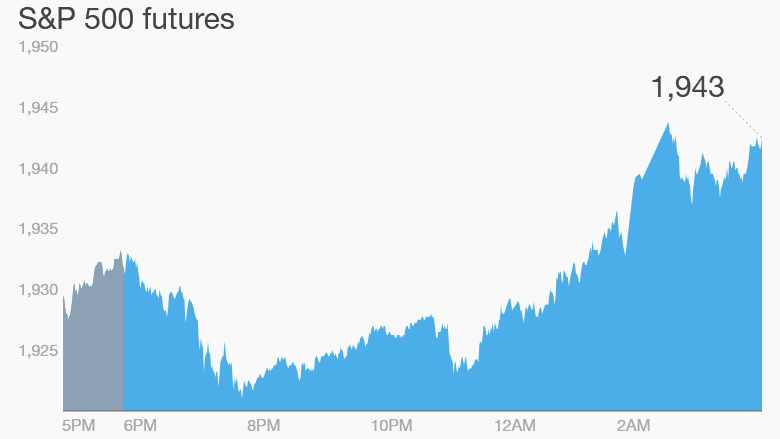

2. Global market overview: U.S. stock futures are moving up. European markets are climbing in early trading and Asian markets ended with gains.

Oil prices continue to edge higher, trading around $34 per barrel. Investors around the world freaked out when oil prices plummeted to a 13-year low of $26.05 a barrel on February 11. But prices have since surged by 30%.

Investors brushed off the latest Chinese manufacturing data showing factories experienced a slump in February. It's the latest sign that the world's second-largest economy is continuing to cool down.

3. Stocks to watch -- Tesla, Valeant, Marathon Oil, Barclays: Watch shares in Tesla (TSLA) Tuesday after about 300 workers walked away from building a massive Tesla battery plant in Nevada.

The workers are protesting Tesla's use of out-of-state contractors. Tesla said that more than 75% of people building the Gigafactory are Nevada residents.

Shares in pharmaceutical firm Valeant (VRX) could be on the move again after the company reportedly confirmed that it is being investigated by the Securities and Exchange Commission.

Valeant stock has plunged by about 70% over the past six months after a short-selling firm accused the company of massive fraud. The company said last week it will restate 2014 and 2015 earnings due to accounting errors.

Shares in Marathon Oil (MRO) look set to drop at the open after the company announced it would sell an additional $1.3 billion in new shares, which will dilute the investments of current shareholders.

Shares in Barclays (BCS) are falling by 10% in London after the British bank reported a bigger-than-expected annual loss of £394 million ($550 million) and slashed its dividend.

The bank said it would scale back heavily in Africa as it continues a retrenchment designed to boost capital levels.

4. Earnings: Companies including Dollar Tree (DLTR), AutoZone (AZO) and JD.com (JD) -- China's e-commerce gaint -- are reporting quarterly results ahead of the open.

Ross Stores (ROST) and Ann Taylor owner Ascena Retail (ASNA) will issue updates after the close.

5. Monday market recap: It was a downbeat day on Monday. The Dow Jones industrial average and Nasdaq each shed 0.7%, while the S&P 500 sunk 0.8%.