1. Dollar flexes 'merican muscle: The U.S. dollar hasn't been this strong since early 2003.

The ICE Dollar Index -- which tracks the dollar's value versus other major global currencies -- hit 101.37 Friday, up about 10% from early May.

It's boomed since Election Day because investors expect higher interest rates and more government spending during Donald Trump's presidency.

2. More pain for VW: Volkswagen (VLKAY) is cutting 30,000 jobs as it tries to boost profits in the wake of a huge emissions scandal.

Europe's largest automaker says the cuts are needed to reduce costs as it works to overhaul its plants in Germany.

The vast majority of the job cuts -- 23,000 -- will come in its home market. Volkswagen employs more than 610,000 workers worldwide.

Shares in Volkswagen inched up in Germany on Friday.

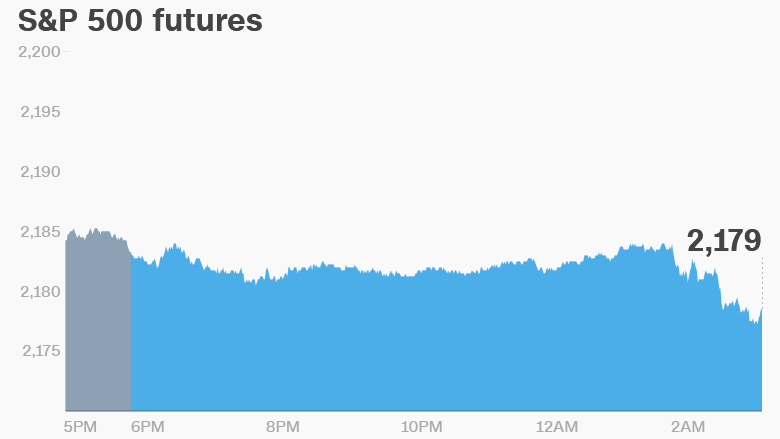

3. Wall Street near record territory: The major U.S. stock market indexes are trading near record highs.

However, it doesn't look like today will necessarily be a record-setting day as U.S. stock futures are looking rather weak.

For those who like to keep score: The Dow Jones industrial average is just 30 points away from its highest-ever level, and the S&P 500 and Nasdaq need less than 10 points to hit new record highs.

Looking abroad, European markets are mostly declining in early trading. Asian markets ended the week with mixed results.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Earnings: More retail earnings are coming through.

Abercrombie & Fitch (ANF), Buckle (BKE) and Foot Locker (FL) are releasing earnings before the bell Friday.

Meanwhile, shares in Salesforce.com (CRM) and Gap (GPS) should be on the move when trading opens after the companies released earnings on Thursday afternoon. Salesforce.com stock is set to surge, while Gap shares are heading south.

Download CNN MoneyStream for up-to-the-minute market data and news

5. Coming this week:

Friday - "Fantastic Beasts and Where to Find Them" release, "The Grand Tour" premieres on Amazon Prime