1. Underneath the hood: U.S. auto sales for December will be released Wednesday by the likes of Ford (F) and GM (GM).

Sales are forecast to hit a new record in 2016, but the auto sales boom could be leveling off.

Many anticipate a decline in 2017 sales following years of consecutive gains.

2. Tesla falls short: Tesla (TSLA) reported late on Tuesday afternoon that it fell short of its goal for 80,000 auto deliveries in 2016.

The electric car manufacturer delivered 76,230 cars in 2016.

That's still far more than the roughly 50,000 cars it delivered a year earlier.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. ExxonMobil's 'conflict of interest' plan: ExxonMobil (XOM) and its former CEO Rex Tillerson have announced their plan to address concerns about the huge nest egg the oil giant has promised to Tillerson.

Tillerson, who's been nominated as secretary of state by President-elect Donald Trump, is due to receive more than 2 million Exxon shares -- worth more than $181 million at current prices -- over the next decade.

To tackle the ethical and legal problems raised by the massive payout, Exxon said late Tuesday that if Tillerson is confirmed for the high-ranking government job, it plans to put the value of the shares he would have received in an independently managed trust. The trust won't be allowed to invest in the oil company.

Federal law prohibits government employees from taking actions that could affect their personal stock holdings.

4. Fed focus: The U.S. Federal Reserve is scheduled to release the minutes from its important December meeting at 2 p.m. ET. That's the meeting where the Fed raised interest rates for only the second time in a decade.

Wall Street will be scrutinizing the minutes to see whether Fed members talked about the impact of Trump's stimulus plans on future rate hikes.

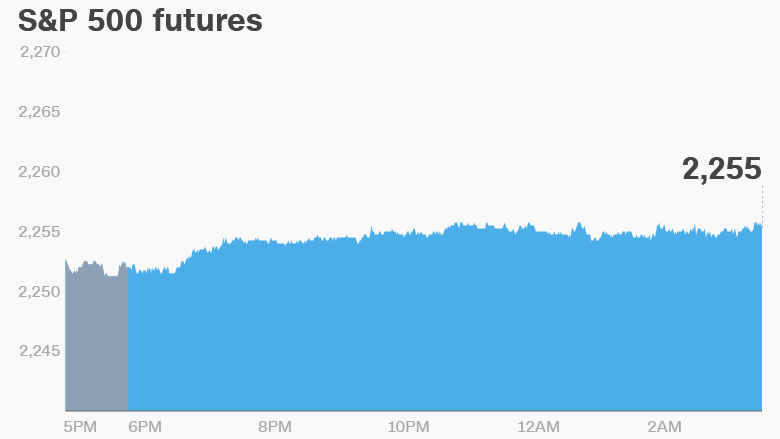

5. Global market overview: U.S. stock futures are holding steady, indicating that markets will continue trading close to the record-setting levels hit in late 2016.

European markets are looking a bit weak in early trading. Most Asian markets ended the day with gains.

This follows some solid performance in the U.S. on Tuesday. The Dow Jones industrial average jumped 0.6%, while both the S&P 500 and Nasdaq surged 0.9%.

Xerox (XRX) was the best performer across all these indexes, surging 20% after announcing it had completed its separation from Conduent Incorporated (CNDTWI).

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Wednesday - Fed releases notes on its December meeting, Auto manufacturers report December sales

Thursday - Boeing's (BA) 2016 commercial plane order report

Friday - Release of U.S. jobs report for December