1. Earnings bonanza: ExxonMobil (XOM), Mastercard (MA), Aetna (AET), Under Armour (UA), Sprint (S) and UPS (UPS) are some of the key companies releasing earnings before the open.

Investors will be keeping a particularly close eye on oil giant ExxonMobil -- whose former CEO Rex Tillerson has been nominated as Trump's secretary of state.

Apple (AAPL), Electronic Arts (EA) and U.S. Steel (X) are set to release earnings after the close.

The Apple results will show how successful the iPhone 7 was during the holiday season.

In Japan, shares in Nintendo declined by nearly 2% Tuesday after the firm reported its latest earnings.

2. Fed meets to discuss rates: The U.S. Federal Reserve will kick off a two-day meeting to discuss interest rates and monetary policy.

Fed chair Janet Yellen said earlier this month that the economy is near maximum employment and inflation was moving closer to the central bank's goal. Yellen reiterated that she and other Fed leaders expect to raise rates a "few times a year" until 2019.

The Fed may also discuss President Donald Trump's new policies and their economic impact. Before Trump took office, Fed officials said there was "considerable uncertainty" surrounding his plans.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Global market overview: Investor enthusiasm is waning on the final day of January.

Traders are considering President Trump's latest moves related to his travel ban, which bars citizens of seven Muslim-majority countries from entering the United States for 90 days.

Trump fired acting Attorney General Sally Yates Monday night for "refusing to enforce" the order.

"Trump's decision to fire the acting U.S. Attorney General caused equity markets to weaken," said Paul Donovan, global chief economist at UBS Wealth Management. "Diversity and tolerance are not just morally good, they are also good for profits. Challenging diversity and tolerance has long-term profit implications."

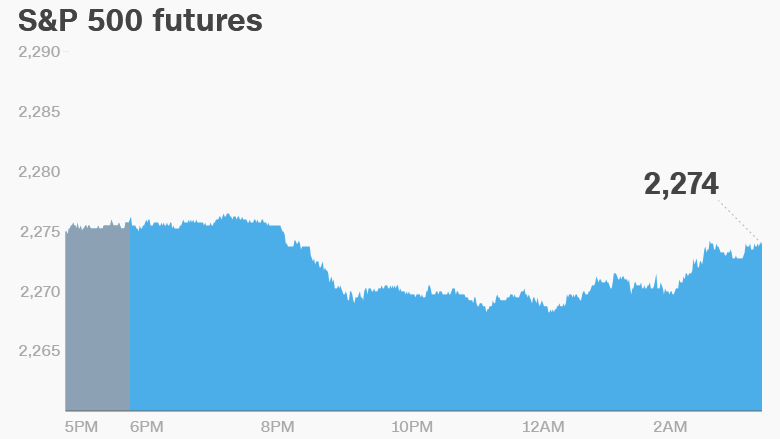

U.S. stock futures have dipped into the red.

European markets were mostly higher in early trading. Most Asian markets ended the day with losses.

The Dow Jones industrial average, S&P 500 and Nasdaq all dropped on Monday.

4. Deutsche Bank in trouble: German lender Deutsche Bank (DB) is facing roughly $630 million in fines for failing to deal with a Russian money-laundering scheme that used its London and New York branches.

This follows a $7.2 billion settlement Deutsche Bank reached with the U.S. last month over toxic mortgage assets and the $2.5 billion it agreed to pay in 2015 over interest rate manipulation.

Shares in the bank were up by nearly 2% in European trading.

5. Economics: The latest monthly S&P Case Shiller Home Price Index will be released at 9 a.m. ET.

The Conference Board's Consumer Confidence Index for January is out at 10 a.m. ET.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Tuesday - Fed meeting begins; Last day for Obamacare open enrollment; Apple (AAPL) reports earnings

Wednesday - Facebook (FB) earnings; Auto sales reports

Thursday - Amazon (AMZN) and Chipotle (CMG) earnings

Friday - U.S. jobs report for January