1. Jobs report: The first U.S. employment report of the Trump era is out and it's better than expected.

Labor Department statistics showed the U.S. economy added 227,000 new jobs in January. The unemployment rate ticked up a bit to 4.8%.

Economists had been expecting only 175,000 new jobs in January.

President Trump has slammed the jobs numbers in the past, saying the unemployment rate data was a hoax.

The data is produced by the Bureau of Labor Statistics, a wing of the Labor Department. The formula for the unemployment rate hasn't changed in years.

"U.S. President Trump indicated he does not believe the data. This is sensible. Employment data is revised frequently, and mainly survey-based. Rather than trust a single data release, economists look at trends. Trends show the U.S. at full employment," said Paul Donovan, global chief economist at UBS Wealth Management.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. Trump meets his CEO team: The new president is scheduled to meet with a group of influential CEOs he's tapped to share their views on the economy.

The group, dubbed the Strategic and Policy Forum, is led by Blackstone (BX) boss Stephen Schwarzman and includes JPMorgan Chase (JPM) CEO Jamie Dimon and Tesla (TSLA) founder Elon Musk.

Uber CEO Travis Kalanick has pulled out of the group.

3. Market movers -- Visa, Amazon and more: Shares in Visa (V) were higher in extended trading after the firm reported strong earnings on Thursday.

But investors were unimpressed with the earnings from Amazon (AMZN), GoPro (GPRO), FireEye (FEYE) and HanesBrands (HBI). Shares in these companies are set to drop at the open. FireEye shares are down by about 19% premarket.

Meanwhile, more earnings are coming through on Friday morning from Clorox (CLX), Hershey Foods (HSY), Honda Motors (HMC) and Phillips 66 (PSX).

4. Global market overview: Investors have a spring in their step on Friday morning.

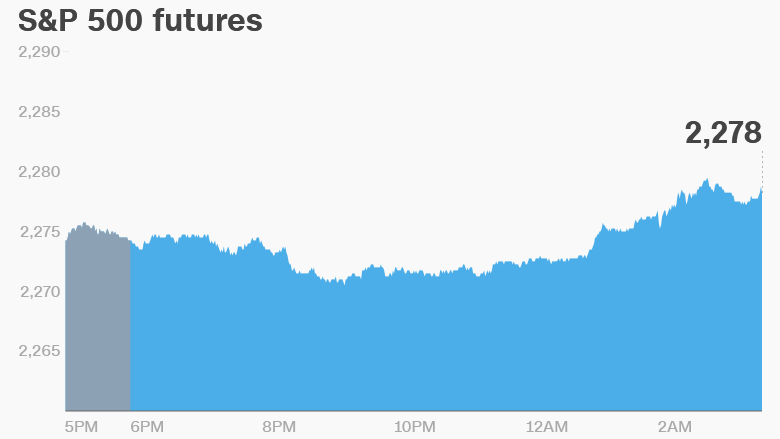

U.S. stock futures are moving up. They got an extra boost from the jobs report.

European markets are all positive in early trading. However, global mining firms are seeing their shares slump a bit, which is holding back the indexes.

Asian markets are mostly closing with small losses.

This follows a relatively calm trading session on Thursday. The Dow Jones industrial average was flat, while the S&P 500 moved up 0.1% and the Nasdaq dipped 0.1%.

Download CNN MoneyStream for up-to-the-minute market data and news

5. Coming this week:

Friday - U.S. jobs report