1. Retail heavyweights weigh in: Walmart (WMT), Macy's (M) and Home Depot (HD) will all report quarterly results before Tuesday's opening bell.

Investors will be looking to see if surging U.S. consumer confidence has translated into sales growth.

Macy's may also to respond to rumors about a potential sale of the iconic department store chain.

2. Central bank chatter: Top officials from the U.S. Federal Reserve are expected to make public speeches Tuesday, which could give investors more insights into their expectations for the U.S. economy and interest rates.

Comments from Fed officials Neel Kashkari, Patrick Harker and John Williams could have significant sway over market moves.

Additionally, the head of the Bank of England -- Mark Carney -- is making a public appearance to discuss the economy and prices.

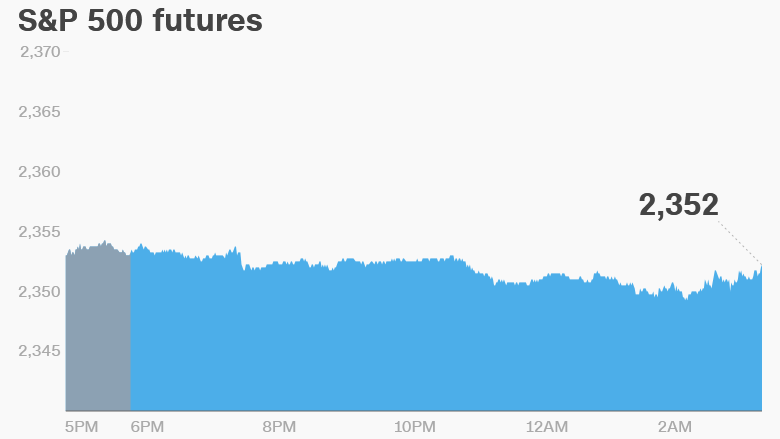

3. Global market overview: U.S. stock futures are pushing up following the long weekend.

The Dow Jones industrial average, S&P 500 and Nasdaq are currently sitting at their highest closing levels ever. If stocks have another strong day, it will be the eighth consecutive trading session where they've hit new records.

Investor sentiment has been boosted by expectations that President Trump will introduce business friendly policies and reduce corporate taxes.

European markets are mixed in early trading. Most Asian markets ended the day with positive results.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Food fights: Shares in Kraft Heinz (KHC) are set to take a tumble on Tuesday, the first U.S. trading session since Unilever (UL) turned down its $140 billion takeover bid.

Meanwhile, shares in Popeyes Louisiana Kitchen (PLKI) could pop at the open following reports that Burger King's parent company -- Restaurant Brands International (QSR) -- is in discussions to buy the chain.

Download CNN MoneyStream for up-to-the-minute market data and news

5. HSBC slumps: Shares in HSBC (HSBC) are getting crushed in London trading after the U.K.-based bank reported an unexpected net loss of $4.2 billion in the fourth quarter of 2016. The biggest single hit to its battered bottom line came from a $2.4 billion writedown of the value of its private banking business in Europe.

The global banking giant has spent years cleaning up its private banking operations, notably in Switzerland. The business came under scrutiny over allegations that it catered to weapons dealers, tax evaders and dictators.

6. Coming this week:

Tuesday - Walmart (WMT), Macy's (M), Home Depot (HD) earnings

Wednesday - Tesla (TSLA), Fitbit (FIT) earnings

Thursday - Gap (GPS), Kohl's (KSS), Nordstrom (JWN) earnings

Friday - J C Penney (JCP), Foot Locker (FL) earnings