1. Economics in focus: There are plenty of economic puzzle pieces to put together on Tuesday.

The U.S. Census Bureau will release its trade balance report for January at 8:30 a.m. ET. The numbers are expected to show the U.S. trade deficit with the rest of the world widened to about $49 billion from $44.3 billion, meaning the country was importing more than it was exporting.

Looking further afield, a new report shows the eurozone economy grew by 1.7% in the fourth quarter. This was in line with expectations and slightly slower than U.S. growth over the same period.

However, German industrial orders in January delivered a nasty shock, slumping 7.4%.

In South America, new figures from Brazil show the country continues to grind through its longest recession ever, spanning eight consecutive quarters.

Brazil's economy shrank 3.6% in 2016. That's just a slight improvement from 2015, when it contracted 3.8%, but still far from good.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. Earnings: Dick's Sporting Goods (DKS) is set to release earnings before the open Tuesday, while H&R Block (HRB) and Urban Outfitters (URBN) are set to release earnings after the close.

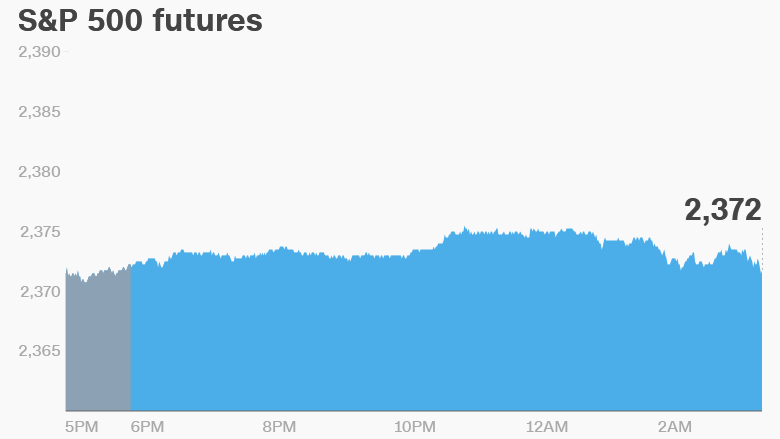

3. Global market overview: Markets have lacked direction since U.S. stocks hit record highs last week.

U.S. stock futures were dipping on Tuesday morning. European markets were mostly declining in early trading.

But most Asian markets ended the day with small gains.

On bond markets, prices for U.S. 10-year Treasuries are sinking, pushing up yields to 2.5%. This comes as the vast majority of investors expect the U.S. Federal Reserve to hike rates next week.

"It is a rare event indeed when Bloomberg's World Interest Rate Probability screen is telling me that there is a 98% chance of a Fed rate hike in eight days' time," noted Kathleen Brooks, research director at City Index. "Expectations for a Fed rate hike are rarely this high with more than a week to go until the rate decision."

On Monday, the Dow Jones industrial average, S&P 500 and Nasdaq all retreated. Each of these indexes were down by between 0.2% to 0.4%.

Download CNN MoneyStream for up-to-the-minute market data and news

4. Snap fizzles out: Snapchat's parent company Snap (SNAP) will be in the spotlight again after shares fizzled on Monday.

Snap stock tanked more than 12% in trading Monday, ending the day at $23.77 a share. That puts Snap below its first day opening price of $24.

Analysts have been raising significant concerns about Snap's user growth, valuation and hype. The company's shares debuted on Wall Street last week.

5. Coming this week:

Tuesday - Urban Outfitters (URBN) earnings

Wednesday - "A Day Without a Woman" general strike

Thursday - Geneva International Motor Show officially begins

Friday - Monthly U.S. jobs report released