1. It's a pullback, not a sell-off: Global stocks are in retreat mode Wednesday, but losses are relatively minor.

Investors are taking some money off the table following a record-setting, Trump-inspired rally. And they're putting their cash into government bonds.

"There is no obvious explanation for the poor performance but markets might be starting to question President Trump's ability to deliver on his policy promises," said Andreas Johnson, an economist at Swedish bank SEB.

Crude oil futures also declined to trade at their lowest levels of the year, just below $47.50 per barrel.

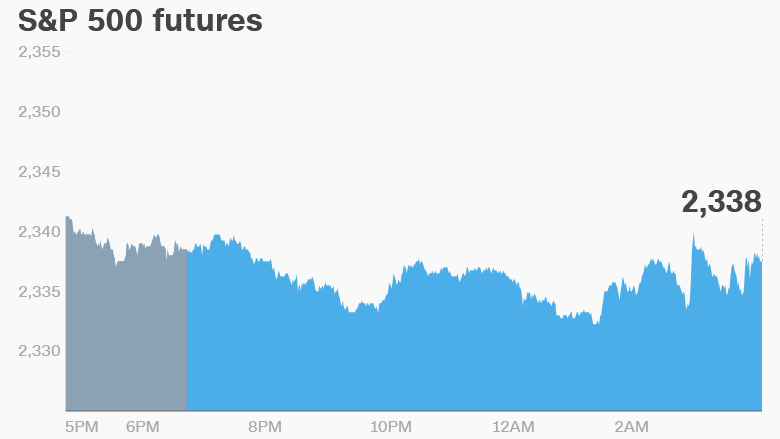

U.S. stock futures were edging down a bit.

European markets declined in early trading, with many indexes down by about 1%.

Asian markets ended the day with losses. Japan's Nikkei notched the biggest drop of 2.1%.

The moves follow a sizable drop for U.S. stocks on Tuesday. The Dow Jones industrial average fell 1.1%, the S&P 500 declined 1.2% and the Nasdaq was down 1.8%.

The pull back started on the same day that Bank of America Merrill Lynch released a survey showing that 34% of fund managers believe stocks are "overvalued".

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. Stock market movers -- FedEx, Nike, Fiat Chrysler, ING: Shares in FedEx (FDX) were being delivered up in extended trading while shares in Nike (NKE) were kicked down after both companies released new quarterly earnings.

Shares in Fiat Chrysler (FCAU) declined by 3% in Europe on reports that French prosecutors are investigating the auto group over cheating on emissions tests. The company did not immediately return requests for comment.

Shares in the Dutch bank ING (ING) dropped by about 6% after the company said it's being investigated in Europe and the U.S. for issues related to "money laundering and corrupt practices." It warned that potential fines "could be significant."

3. Takeover turned down: U.S. firm PPG Industries (PPG) is not having much luck with its attempts to woo and acquire the Dutch chemical firm AkzoNobel.

AzkoNobel, which makes Dulux paint, said Wednesday is rejected a second unsolicited offer from PPG. The offer of cash and stock was valued around €22.4 billion ($24.2 billion).

Shares in AzkoNobel declined 3% in Europe after hitting an all-time high on Tuesday.

4. Housing market in the Trump era: Economists expect a report from the National Association of Realtors to show that sales of existing homes in the U.S. cooled off in February. The report is out at 10 a.m. ET.

Existing home sales increased 3.3% in January, which was the strongest pace of sales since early 2007.

Download CNN MoneyStream for up-to-the-minute market data and news

5. Coming this week:

Wednesday - U.S. existing home sales report; Starbucks (SBUX) annual shareholder meeting

Thursday - Accenture (ACN) reports earnings; U.S. new home sales report

Friday - Samsung annual shareholder meeting