1. Stocks catch a cold: Global investors are in a bad mood right now after President Trump failed his first big legislative test as Republicans ditched their Obamacare repeal bill on Friday.

Analysts say investors are selling as they worry this indicates Trump may fall short on his other big policy plans.

"The Trump 'disappointment trade' is now in full swing," said Kathleen Brooks, research director at City Index. "The healthcare bill, although it ultimately won't have a big impact on the economy, was a major litmus test for the president, who has an aggressive policy agenda."

Brooks said a major underlying concern is that Trump won't be able to spend as much as he promised on things like infrastructure, which would support the economy and jobs.

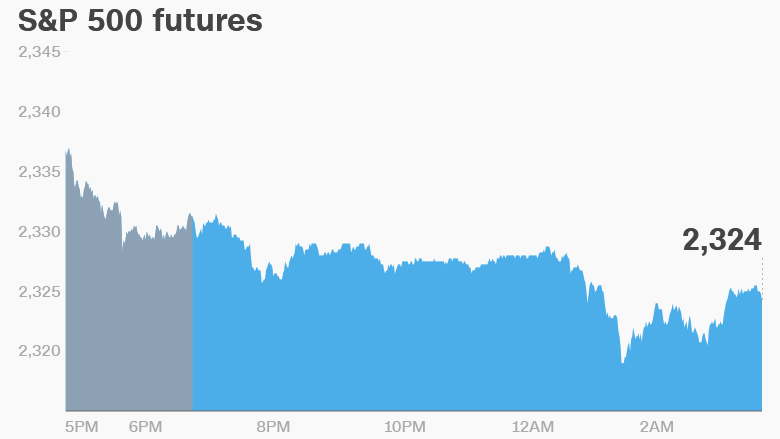

U.S. stock futures are all down by nearly 1%. The U.S. dollar is also weakening versus most major currencies.

The Vix volatility index is surging by 15% to hit its highest level since the U.S. election in November.

The majority of European markets are falling in early trading. And most Asian markets closed with losses.

This follows a lackluster week of trading in the U.S. The Dow Jones industrial average tumbled 1.5%, while the S&P 500 fell 1.4% and the Nasdaq dropped 1.2%.

"We expect losses from banking stocks, materials and construction firms, and healthcare companies in the next few days as the markets adjust to this setback for Trump," said Brooks.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. Stock market mover -- Bank of America: Shares in Bank of America (BAC) are slumping by about 2% premarket following a 7% drop over the past week.

Bank of America, like other financial stocks, was a big beneficiary of the post-election Trump rally but now traders have gone cold on the banking giant.

3. Oil slips again: Shares in many energy companies are pushing lower as crude oil prices are declining by about 0.7% to trade around $47.70 a barrel.

This comes despite a report from OPEC that said producers' compliance with output cuts rose to 94% in February. But the oil cartel acknowledged that higher non-OPEC supply was undermining the impact of those production cuts and said it would consider extending them beyond June, when they're due to expire.

Oil prices had been trading north of $50 per barrel since late 2016 when OPEC announced major production cuts. But the price has dropped since the beginning of this month due to concerns about high supply levels.

Download CNN MoneyStream for up-to-the-minute market data and news

4. Coming this week:

Monday - Wall Street Green Summit begins

Tuesday - U.S. Conference Board releases monthly Consumer Confidence Index; New £1 coin enters circulation in U.K.; Hillary Clinton delivers keynote speech at Professional BusinessWomen of California Conference; Carnival Corp (CCL) earnings

Wednesday - Samsung launches new Galaxy S8 smartphone; U.K. set to trigger Brexit negotiations; Lululemon (LULU) earnings

Thursday - U.S. Bureau of Economic Analysis releases updated GDP report for fourth quarter; H&M (HNNMY) earnings

Friday - Blackberry (BBRY) earnings; Final day of the first quarter of 2017