1. Global market overview: Investors are still in an anxious and indecisive mood, with stock markets showing no clear trend in either direction.

"There's an abundance of angst this morning, stemming from weak U.S. car data, the explosion in the St. Petersburg subway, the prospect of Donald Trump meeting [Chinese President] Xi Jinping at the end of the week and the rapidly approaching French election," noted Kit Juckes, a strategist at Societe Generale.

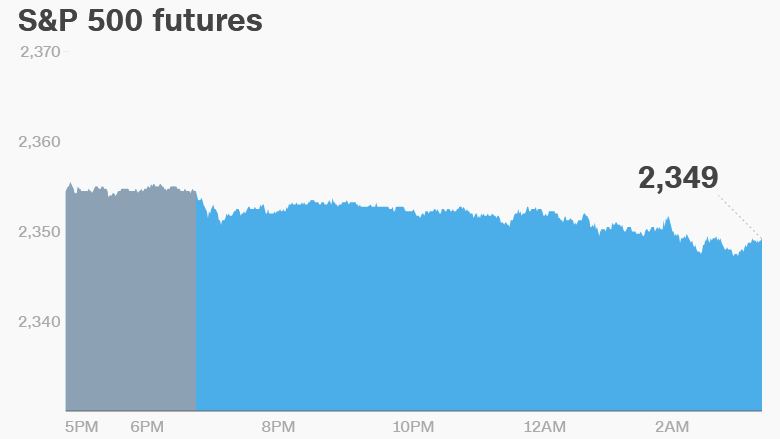

U.S. stock futures are pointing down and the Vix volatility index is edging up. Volatility has been seeping back into the markets over the past three trading days.

European markets are mixed in early trading. Asian markets ended with minor losses.

This comes after the Dow Jones industrial average, S&P 500 and Nasdaq all posted small losses on Monday.

Bond markets are equally mixed. Yields around the world are falling Tuesday with the exception of the U.S., where 10-year Treasuries are ticking higher.

2. Shudders in South Africa: The South African rand continues to fall as traders react to S&P downgrading the country's debt rating to junk status.

President Jacob Zuma ousted his respected finance minister last week, causing analysts and investors to worry about the future health of the country's economy.

The rand has dropped by 10% in reaction to the political turmoil.

S&P warns that "political risks will remain elevated this year, and ... policy shifts are likely, which could undermine fiscal and economic growth outcomes more than we currently project."

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Economics: The Census Bureau will announce U.S. trade deficit data for February at 8:30 a.m. ET.

This comes as Trump gets ready to sit down with President Xi later this week. Trump has already said massive trade deficits with China will make the meeting "a very difficult one."

And on the other side of the world, Australia's central bank left interest rates unchanged at 1.5%.

Download CNN MoneyStream for up-to-the-minute market data and news

4. Coming this week:

Tuesday - Equal Pay Day; Senate votes on whether to confirm President Trump's nominee Jay Clayton to become a member of the Securities and Exchange Commission

Wednesday - Earnings from Monsanto (MON), Walgreens Boots Alliance (WBA) and Bed Bath & Beyond (BBBY); World Economic Forum on Latin America begins in Buenos Aires, Argentina

Thursday - Chinese President Xi Jinping visits President Trump at his Mar-a-Lago golf club.

Friday - U.S. Bureau of Labor Statistics releases monthly jobs report for March.