1. Attack in Paris: A gunman killed one police officer and injured two others in Paris on Thursday. The attack, claimed by ISIS, came just days before a general election in France.

The euro was little changed against the dollar on Friday, while French stocks dipped by 0.6%.

Investors are closely watching the election. Opinion polls suggest a very close race between four presidential hopefuls, including far right candidate Marine Le Pen and the far left politician Jean Luc Melenchon.

The top two candidates will advance to a runoff scheduled for May 7.

The difference in yields on French and German government bonds has widened recently, suggesting that investors see French debt as an increasingly risky bet.

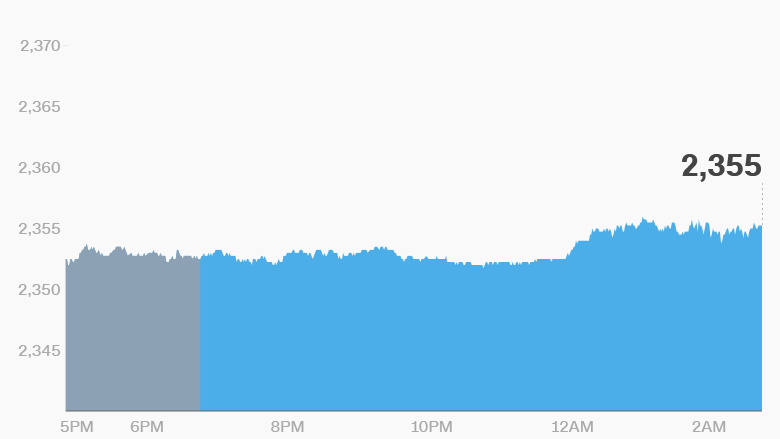

2. Markets whiplash: U.S. stocks have been on a wild ride this week, but futures were pointing to a higher open on Friday.

The Dow Jones industrial average added 175 points Thursday after suffering two days of heavy losses.

The S&P 500 closed 0.8% higher, while the Nasdaq increased 0.9%. Steel stocks soared after President Trump launched an investigation into whether foreign companies have flooded the market with cheap steel.

There's more uncertainty on the horizon: The government's current temporary spending bill expires on April 28. If Congress doesn't pass a spending bill soon, and if the president doesn't sign it, the U.S. could be heading for a government shutdown next week.

3. Samsung big release: Americans will be able to buy the new Samsung Galaxy S8 starting Friday.

It's Samsung's first big rollout since its fire-prone Galaxy Note 7 debacle. Samsung (SSNLF) shares were up 1.2% in Korea on Friday.

The new smartphone was supposed to feature a digital assistant, Bixby, which is seen as a competitor to Apple's Siri. But Samsung said last week that Bixby won't be fully operational until later.

The S8 is expected to launch globally later this month.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Stock market movers -- Visa, Mattel: Visa (V) shares were higher in premarket trading after the company reported strong earnings on Thursday.

Mattel (MAT) shares were heading the opposite direction after the toy maker said its sales slumped 15% in the first quarter.

5. Earnings and economics: General Electric (GE) and Honeywell (HON) are set to release earnings before the open on Friday.

Schlumberger (SLB), the world's biggest provider of oilfield services, will also report before the bell.

A report on existing home sales for March is set to be released at 10 a.m. ET. At the same time, Baker Hughes will publish its closely watched U.S. oil rig count data. Investors will be looking for more signs of activity in the U.S. shale oil industry.

The International Monetary Fund and the World Bank leaders will continue their meetings in Washington on Friday.

6. Global markets overview: European markets opened flat on Friday. Markets in Asia ended the session mixed.

Download CNN MoneyStream for up-to-the-minute market data and news

7. Coming this week:

Friday - U.S. release of Samsung's (SSNLF) Galaxy S8