1. Tax plan: President Trump plans to present his new tax plan on Wednesday.

Businesses will be interested to see if Trump explicitly pushes for the 15% corporate tax rate he promised during the campaign.

Another key question is whether Trump calls for real tax reform or just fleeting tax cuts.

The plan is likely to face a couple major hurdles: Tax cuts are expensive, and Trump risks angering deficit hawks if he hasn't found a way to make up for the lost revenue. Democrats are unlikely to vote for the proposal without major concessions.

"Stocks may pause on Wednesday as the market waits for the reaction from Congress who actually has to pass the bill," said Kathleen Brooks, the research director at City Index.

2. Boeing earnings: Boeing (BA) will release its quarterly earnings before the opening bell on Wednesday. The company said earlier this month that the number of planes it delivered in the first quarter dipped this year compared to 2016.

Investors will be looking for any comments on Boeing's efforts to sell airliners to Iran.

Relations between Iran and the U.S. have been strained under Trump, who has been critical of the nuclear deal that was signed under the Obama administration. The deal made the Boeing sales possible.

3. Earnings bonanza: A slew of major companies will report their quarterly results on Wednesday.

Anthem (ANTX), Boeing (BA), Dr Pepper Snapple (DPS), PepsiCo (PEP), Fiat Chrysler (FCAU) and Procter & Gamble (PG) are among the firms set to release earnings before the opening bell. PayPal (PYPL) and Amgen (AMGN) will follow after the close.

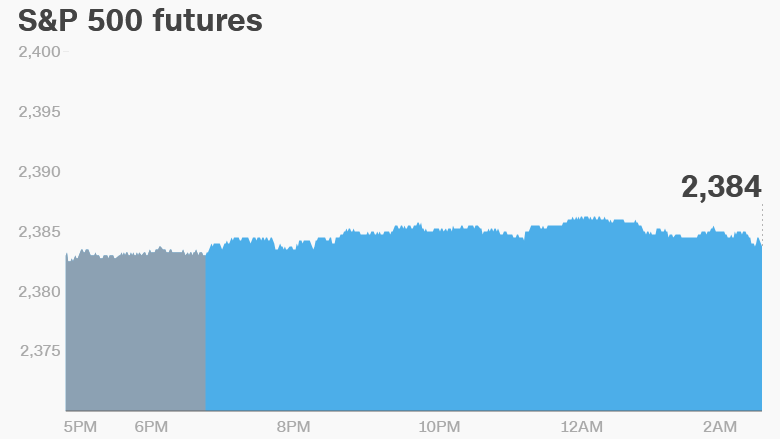

4. Global market overview: U.S. stock futures were flat early on Wednesday.

Most European markets opened lower, as the French election rally began to fade. Asian markets ended the session higher.

The Dow Jones industrial average closed 1.1% higher on Tuesday, while the S&P 500 added 0.6%. The Nasdaq increased 0.7% to surpass the 6,000 point milestone.

Oil prices dipped further below $50 per barrel ahead of the latest U.S. crude inventories report at 10:30 a.m. ET.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Stock market movers -- Kering: Kering (PPRUY), the owner of luxury brand Gucci, shot up 10% in early trading in Paris after it reported record sales in the first three months of the year.

Wynn Resorts Ltd (WYNN) shares were set to open higher after the company reported strong earnings.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Wednesday -- Steve Mnuchin speaks on tax reform; Twitter (TWTR) reports earnings; Crude oil inventories report

Thursday -- Alphabet (GOOGL), Microsoft (MSFT) and Amazon (AMZN) report earnings; ECB meeting; U.S. trade balance data

Friday -- GM (GM) earnings; U.S. and U.K. first quarter GDP data