1. Trump moves on NAFTA: President Trump has announced plans to renegotiate the North American Free Trade Agreement.

Trump railed against the trade deal as a candidate and as recently as last week declared it harmful to U.S. workers.

Trump's decision to renegotiate NAFTA came the same day a senior administration official revealed the White House was considering an executive order to withdraw from the trade accord.

The Mexican peso climbed 1% against the dollar. The Canadian dollar also strengthened.

2. Tech earnings: A slew of tech companies will release quarterly financial reports on Thursday.

Tech stocks have had a good month, with many hitting record highs. That helped the Nasdaq, where most are listed, to briefly cross the 6,000 point barrier earlier this week.

Alphabet (GOOG), Amazon (AMZN), Baidu (BIDU), GoPro (GPRO), Intel (INTC) and Expedia (EXPE) are all set to release their results after the bell.

Some U.S. tech firms have vast amounts of cash sitting overseas. Investors will be looking for reactions to Trump's plans for a tax repatriation holiday.

Microsoft (MSFT) will also report after the close. Investors are likely to focus on the performance of its cloud computing business, which has pushed the stock higher in recent months.

3. Tax plan questions: The Trump administration outlined its new tax proposal Wednesday. Trump wants to slash the top individual tax rate from 39.6% to 35% and reduce the number of tax brackets from seven to three.

He also intends to cut the top tax rate for all businesses to 15%.

But the plan leaves many questions unanswered.

"Market participants are holding back their enthusiasm until they see detail of how [the plan] will be funded," said Kit Juckes, a strategist at Societe Generale.

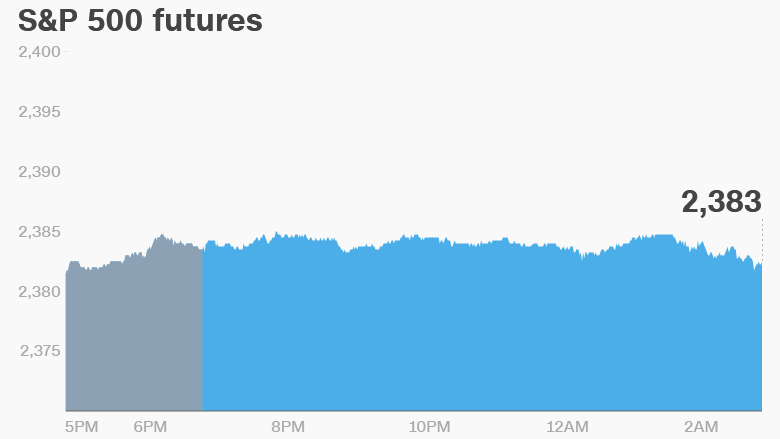

4. Global market overview: U.S. stock futures were higher early Thursday.

European markets opened lower, while Asian markets ended the session mixed. Japan's Nikkei and India' Sensex were lower, while markets in China and Hong Kong climbed higher.

The Dow Jones industrial average closed down 0.1% on Wednesday, while the S&P 500 was shed 0.1% and the Nasdaq was flat.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Stock market movers -- Intuit, Paypal: Intuit (INTU) shares rallied more than 7% in extended trading after it reported a boost in sales of its TurboTax software.

Shares in Paypal (PYPL) were up in extended trading after the payment company reported better then expected first quarter profits.

6. Earnings and economics: American Airlines (AAL), Bristol-Myers (BMY), Comcast (CMCSA), Domino's Pizza (DPZ), Ford (F) and Union Pacific (UNP) are set to release earnings before the open Thursday, while Starbucks (SBUX) will release earnings after the close.

The U.S. Census Bureau is set to release its advance goods trade balance statistics for March at 8:30 a.m. ET. The durable goods orders report for March is expected at the same time.

Download CNN MoneyStream for up-to-the-minute market data and news

The Bank of Japan left key interest rates unchanged at its meeting earlier Thursday.

The European Central Bank will make a rate decision at 7:45 a.m. ET, followed by an 8:30 a.m. ET press conference by the bank's president Mario Draghi.

The ECB chief is likely to be asked about a potential scaling back of the bank's giant stimulus program. Analysts don't expect any new details on the bank's plans to be announced on Thursday.

7. Coming this week:

Thursday -- Alphabet (GOOGL), Microsoft (MSFT) and Amazon (AMZN) report earnings; ECB meeting; U.S. trade balance data

Friday -- GM (GM) earnings; U.S. and U.K. first quarter GDP data