1. A new deal for Greece: European finance ministers have agreed to unlock loans worth 8.5 billion euros ($9.5 billion) that Athens needs to make crucial debt repayments due in July.

The deal removes the immediate threat of a new Greek crisis. But no agreement was struck on the bigger issue of whether creditors should ease the country's debt burden.

The International Monetary Fund also agreed on Thursday to join the bailout. But it will contribute funds only when Europe provides more clarity on the debt relief the IMF says Athens desperately needs.

2. Nestle puts its U.S. business up for sale: Nestle is considering a sale of its U.S. confectionery business.

The business, which had sales of 900 million Swiss francs ($924 million) in 2016, includes the iconic snack brands Butterfinger, BabyRuth, 100Grand, Raisinets, SweeTarts, LaffyTaffy, Nerds and Runts.

Nestle (NSRGF) shares trading in Europe gained 1.6% following the announcement.

3) Takata bankruptcy? Shares in Takata were halted in Tokyo following reports that the embattled airbag maker is close to filing for bankruptcy.

Reuters said the filing could happen as early next week. Takata shares are down 44% this year.

A spokesperson for the company said that no decision has been made.

Takata has recalled tens of millions of airbags that can explode and send shrapnel into drivers and passengers. The airbags have been linked to at least 11 deaths in the U.S.

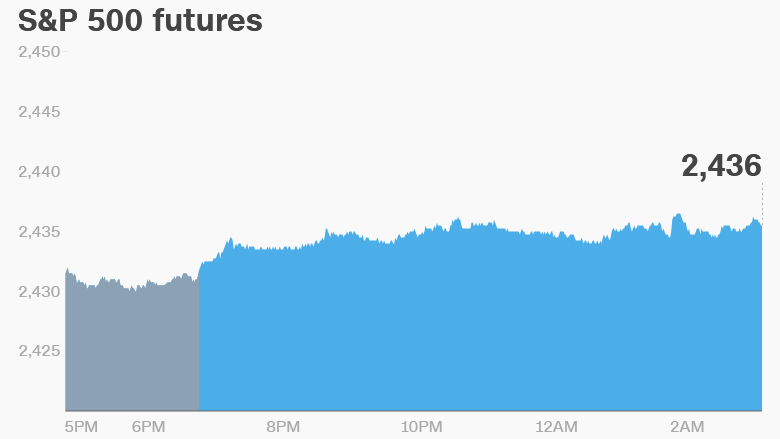

4. Global market overview: U.S. stock futures are higher.

European markets advanced in early trading, following the positive trend set in Asia. The Shanghai Composite was the lone holdout, closing 0.3% lower.

The Dow Jones industrial average shed 0.1% on Thursday, while the S&P 500 dropped 0.2% and the Nasdaq declined 0.5%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Companies and economics: It's all quiet on the earnings front.

Chinese tech giant Tencent (TCEHY) is looking to buy Rovio Entertainment, according to The Information. Rovio is the Finnish company behind Angry Birds.

The U.S. Census Bureau will release data on housing starts and building permits for May at 8:30 a.m. ET.

The University of Michigan's Index of Consumer Sentiment will follow at 10:00 a.m.

The Bank of Japan announced Friday that it will maintain its massive stimulus program at current levels. The central bank said that recent economic data has been positive, but it remains wary of shocks to the economy.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Friday -- U.S. housing market data; University of Michigan's consumer sentiment index