1. Barclays fraud charges: British prosecutors filed criminal charges against Barclays (BCLYF) and four of its former executives Tuesday over investments from Qatar that helped save the bank during the financial crisis.

The executives charged include former CEO John Varley. The bank's stock was 0.4% lower in London.

2. Pound under pressure: The British pound slumped 0.5% against both the euro and the dollar after Bank of England governor Mark Carney said "now is not yet the time" to raise interest rates. The pound was trading just below $1.27.

The U.K. and the European Union kicked off divorce negotiations on Monday.

Britain gave ground by agreeing that talks on its future trading relationship with the EU would only take place when Brussels decides that sufficient progress has been made on other key issues.

3. Lockheed Martin scores in Paris: Lockheed Martin (LMT) says it's working with Tata to make F-16 fighters in India as it tries to beat Saab to a deal to supply the country's military.

The deal was announced at the Paris Air Show on Monday.

The company also said it is nearing a deal worth between $35 billion and $40 billion to supply 440 F-35 Lightning II Joint Strike Fighter jets to the United States and 10 allied nations over the next several years

Company shares gained 0.4% on Monday.

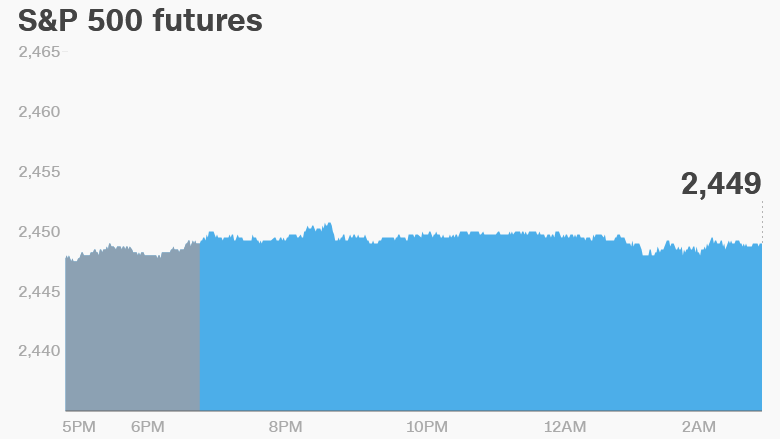

4. Global market overview: U.S. stock futures were edging higher early on Tuesday.

European markets opened higher, while Asian markets ended the trading session mixed.

The Dow Jones industrial average gained 0.7% on Monday, while the S&P 500 advanced 0.8%. Both closed at new record highs.

The Nasdaq gained 1.4% as Apple (AAPL) and Nvidia (NVDA) rallied.

The dollar gained strength against a basket of major currencies on Monday after New York Federal Reserve President William Dudley said he expects prices to rise.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Stock market movers -- Chipotle: Chipotle (CMG) shares dropped in extended trading after the company said it's spending more on marketing and promotions as it tries to recover from a 2015 E. coli outbreak.

6. Earnings and economics: FedEx (FDX) will report its results after the closing bell Tuesday. The company's stock has beaten the broader market and rival UPS this year.

Adobe Systems (ADBE) is also scheduled to post numbers in the afternoon. Its stock has gained 36% so far this year.

Federal Reserve Bank of Dallas President Robert Kaplan is set to speak in San Francisco at 3 p.m. ET.

British regulators will report to the government on whether 21st Century Fox (FOX) should be allowed to acquire the rest of Sky.

Alibaba (BABA) founder Jack Ma is hosting an event for U.S. small businesses in Detroit. Ma wants to create 1 million jobs in the U.S. through the company's e-commerce platform.

The Ifo Institute for Economic Research released a new economic forecast for Germany on Tuesday. It forecast real GDP growth of 1.8% in Germany this year and 2.0% in 2018, a higher rate than previously expected.

Download CNN MoneyStream for up-to-the-minute market data and news

7. Coming this week:

Tuesday -- FedEx (FDX), Adobe (ADBE) earnings; Paris air show; Jack Ma hosts two-day event for U.S. small businesses in Detroit

Wednesday -- Oracle earnings; U.S. housing market data; U.S. crude inventories data; U.K. parliament opening; Paris air show

Thursday -- Barnes and Noble (BKS), Bed Bath & Beyond (BBBY), Accenture (ACN) earnings; Initial jobless claims report; EU consumer confidence data; Central Bank of Mexico rate decision; EU leaders summit; Facebook community event

Friday -- BlackBerry (BBRY) earnings; EU summit