1. EU summit: European Union leaders are meeting in Brussels on Friday.

It's been one year since Britain voted to leave the EU, and the country's departure is at the top of the bloc's agenda.

Divorce negotiations officially kicked off on Monday. On Thursday, British Prime Minister Theresa May said that EU citizens will be given the opportunity to stay in the U.K., her first offer on a major issue that needs to be settled.

How's the British economy looking one year after the vote?

Economic growth slowed to just 0.2% in the first quarter -- the weakest rate in the EU. Consumers are feeling the pinch because of rising prices and slumping wage growth. The pound is trading at $1.27, roughly 14% lower than on the day of the referendum.

2. Healthy banks: The U.S. Federal Reserve said Thursday that all 34 banks it stress tested would be able to lend even if unemployment spiked to 10% and home prices tumbled.

It's the third year in a row that the Fed said all banks would maintain required capital levels in the event of an economic storm.

Not only did U.S. banks haul in more profits than ever last year, but they handed out near-record dividends.

3. American Airlines resit Qatar: American Airlines (AAL) is not happy with Qatar Airways' plan to buy 10% of the company.

CEO Doug Parker sent a letter to American Airlines employees after the news hit on Thursday. He said American Airlines executives "aren't particularly excited" about Qatar's interest in acquiring a big stake in the company, but admitted that there's nothing they can do about it.

American Airlines' stock was up 1.1% on Thursday.

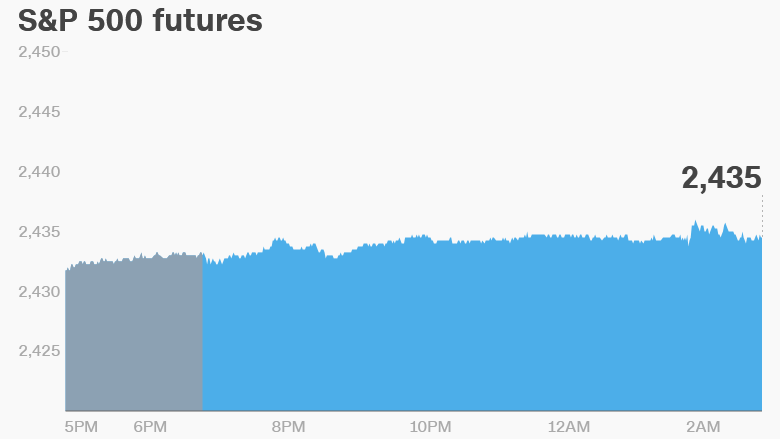

4. Global market overview: U.S. stock futures were edging higher early on Friday.

European markets opened mostly lower, while Asian markets ended the session mixed.

The Dow Jones industrial average and the S&P 500 both closed 0.1% down Thursday. The Nasdaq was flat.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Stock market movers -- Nordstrom; ConocoPhillips; Bed, Bath & Beyond: Nordstrom (JWN) was up in extended trading after CNBC reported that the Nordstrom family, which owns about 30% of the department store chain, is moving ahead with finding a private equity buyer for the company.

ConocoPhillips (COP) shares were also higher after analysts from Goldman Sachs said the company "transformed its business more rapidly than expected."

Bed Bath & Beyond (BBBY) dipped in extended hours after its earnings report fell short of analyst forecasts.

6. Earnings and economics: BlackBerry (BBRY) and Finish Line (FINL) are set to release earnings before the open.

U.S. home sales data for May will be out Friday at 10 a.m. ET. The stats could provide insight on what's been a tough season for house hunters, with competition and prices up in real estate markets across the country.

Download CNN MoneyStream for up-to-the-minute market data and news

7. Coming this week:

Friday -- BlackBerry (BBRY) earnings; EU summit