1. The return of volatility: Thursday was a rough day for stocks.

The Dow Jones industrial average shed 0.8%, while the S&P 500 declined 0.9%. The Nasdaq plunged 1.4% as tech stocks took a hit.

CNNMoney's Fear & Greed Index, which looks at seven measures of market sentiment, ticked over into "fear" territory. Meanwhile, the VIX index of volatility surged as much as 40%.

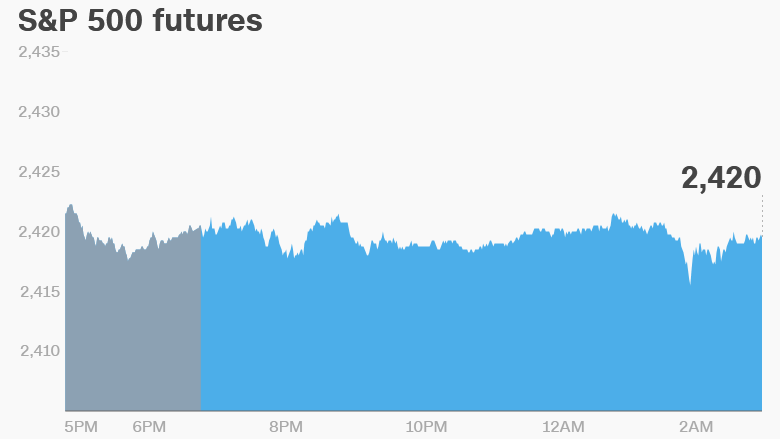

U.S. stock futures were flat early on Friday, suggesting that markets may close out the week with a calmer day.

Friday marks the final trading session of the first half, a period marked by strong stock market returns and exceptionally low volatility.

"Looking into the second half of 2017, we believe it unlikely that low volatility will persist indefinitely having been a prominent feature of the past five years," UBS analysts wrote in a note.

2. Trouble in the G20: German Chancellor Angela Merkel is poised to challenge President Trump's "America First" agenda at next week's G20 summit.

"Anyone who believes they can solve the problems of this world with isolationism and protectionism is making a big mistake," she told German lawmakers on Thursday.

It's the latest sign of a schism between Trump and key U.S. allies on issues related to trade and protectionism.

Merkel, who is running for reelection, also said that Trump's decision to pull out of the Paris climate accord had made Europe "more determined than ever to make it a success."

3. Global market overview: European markets opened mixed. London's FTSE100 was lower in early trading, while markets in France and Germany climbed higher.

Asian markets ended the session mostly lower.

U.S. crude futures were trading 0.6% higher. Oil prices have gained 6% this week.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Stock market movers -- Nike, Arconic: Nike (NKE) was up in extended trading after the company confirmed it will open a shop on Amazon (AMZN).

Peers Foot Locker (FL) and Under Armour (UA) were also higher.

Arconic (ARNCPR), which was spun out of Alcoa (AA) in 2016, was lower in extended trading. The American manufacturer of aluminum composite panels used as cladding in London's Grenfell Tower has halted sales of the product for use in high-rise buildings. Arconic shares have lost 10% this week.

5. Earnings and economics: The Indian film giant Eros International (EROS) is planning to release earnings before the open Friday.

The U.S. Bureau of Economic Analysis will publish its personal income and spending reports for May at 8:30 a.m. ET.

More news on American consumers will follow at 10 a.m., when the University of Michigan releases its survey of consumer sentiment.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Friday -- Personal income and spending data; the University of Michigan consumer confidence survey, China official manufacturing PMI