1. Up, up, up: In case you haven't heard, every major U.S. stock market index hit record highs this week.

The S&P 500 and Nasdaq both hit new peaks during the trading day on Thursday. And the Dow Jones industrial average hit a closing high on Wednesday.

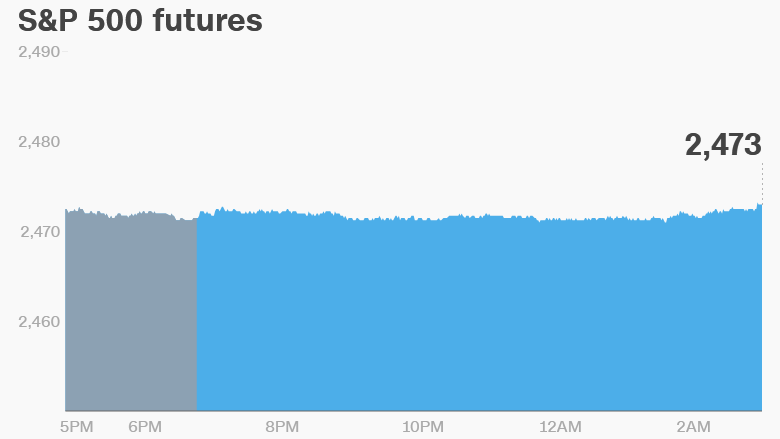

But it's uncertain whether the momentum will carry into Friday, with U.S. stock futures flat.

European markets are mostly dipping in early trading. And most Asian markets ended the week with small losses.

2. Euro mania: The euro continues to flex its muscles on Friday.

The currency has climbed to its highest level in nearly two years against the U.S. dollar. It's also surged against the Japanese yen, British pound and Swiss franc, among others.

The euro got a boost on Thursday. Markets shrugged off the European Central Bank's statement that it will continue with ultra loose monetary policy at least until December. Traders are figuring it's only a matter of time before the ECB starts winding down its quantitative easing program given the strength of the eurozone economy.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Stock market movers: Keep your eyes peeled for companies that reported earnings on Thursday after the close. Some are set for big market moves on Friday.

Specifically, shares in eBay (EBAY) could drop by as much as 4% at the open as investors react to lackluster earnings.

Microsoft (MSFT) and Visa (V) also reported results on Thursday and shares in both firms are edging up in premarket trading.

4. Jeff Immelt's curtain call: General Electric's (GE) CEO is issuing his last earnings report at the helm of the company this morning. Wall Street applauded when Immelt's departure was announced last month because GE stock has lagged the market since he became boss in 2001. New CEO John Flannery takes over on August 1.

Download CNN MoneyStream for up-to-the-minute market data and news

5. Coming this week:

Friday -- General Electric (GE), Honeywell (HON), Colgate-Palmolive (CL) and Moody's (MCO) report earnings