1. Earnings explosion: General Motors (GM), JetBlue Airways (JBLU), McDonald's (MCD), Domino's Pizza (DPZ), Caterpillar (CAT), DuPont (DD) and Eli Lilly (LLY) are releasing quarterly results before the open on Tuesday.

AT&T (T), Chipotle (CMG) and Wynn Resorts (WYNN) will follow after the close.

Investors will be closely monitoring Chipotle results after a new round of bad press: Mice were seen in a Dallas store and customers in Virginia became ill with suspected norovirus.

2. If the shoe fits: Fashion label Michael Kors (KORS) is buying the shoe brand Jimmy Choo for £896 million ($1.2 billion) in cash.

Jimmy Choo, which was founded in 1996 by former Vogue accessories editor Tamara Mellon and designer Jimmy Choo, put itself up for sale in April.

The brand is hugely popular among female fashionistas, and a pair of its stilettos can easily sell for over $1,000.

Michael Kors is best known for its handbags.

Jimmy Choo shares spiked 17% in London after the sale was announced.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Market movers -- Alphabet, Anglo American; Hasbro: Shares in Google parent company Alphabet (GOOGL) are down about 3% premarket after the company reported quarterly results on Monday.

Google posted a rare profit decline as it absorbed a record $2.7 billion European Union antitrust fine last month. The European Commission said Google used its search engine to unfairly steer consumers to its own shopping platform.

Shares in mining giant Anglo American (AAUKF) are surging by about 6% in London after the South African company Kumba Iron Ore -- which is majority owned by Anglo -- reported strong earnings. Anglo American will report results later this week.

Shares in Hasbro (HAS) bounced back in premarket trading after dropping 9.4% on Monday.

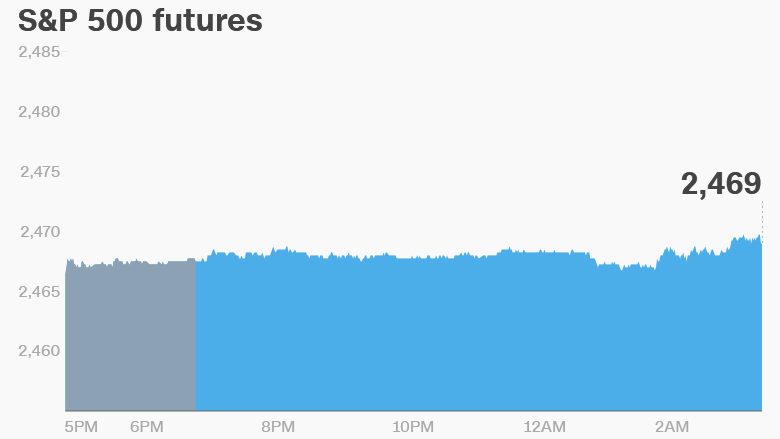

4. Stock market overview: U.S. stock futures are not showing much enthusiasm on Tuesday.

But investors don't have much to complain about. The Dow Jones industrial average and S&P 500 hit all-time highs last week. The Nasdaq rallied another 0.4% on Monday and hit a fresh record high.

Investors will be monitoring politics on Tuesday: The House of Representatives is due to vote on a sanctions bill targeting Russia, Iran and North Korea.

Meanwhile, Senate Republicans will try to advance their latest effort to repeal and replace Obamacare.

European markets were mostly positive in early trading. Asian markets ended the day with mixed results.

5. Economics: The U.S. Federal Reserve will meet Tuesday to discuss monetary policy. The central bank will announce its decision on interest rates on Wednesday.

The monthly S&P Case-Shiller Home Price Index will be published at 9 a.m. ET.

The Conference Board is set to release its Consumer Confidence report for July at 10 a.m.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Tuesday -- McDonald's (MCD), GM (GM), AT&T (T), Chipotle (CMG) earnings

Wednesday -- Federal Reserve interest rate decision; Donald Trump Jr. and former Trump campaign chairman Paul Manafort testify before the Senate judiciary committee; Boeing (BA), Coca-Cola (KO), Ford (F), Facebook (FB), Whole Foods (WFM) earnings

Thursday -- Verizon (VZ), Amazon (AMZN) earnings

Friday -- ExxonMobil (XOM), Chevron (CVX) earnings; U.S. GDP report