1. Power play in Beijing: The new lineup for the Chinese Communist Party's all-powerful Politburo Standing Committee was unveiled Wednesday. The key takeaway? It does not feature a heir apparent to Chinese President Xi Jinping.

Analysts say that Xi has managed to tighten his already strong grip on power, and predict he will continue dominate the country's politics for decades to come.

"There are few signs that Xi plans to use his increased power to resolve China's key structural problems," said Julian Evans-Pritchard, China economist at Capital Economics.

"The only silver lining is today's promotion of key officials that favor greater reform, which offers a modicum of hope that policy could shift in a more liberal direction in future," he added.

Chinese stocks were higher on Wednesday.

2. U.K. GDP: Britain's economy expanded by 0.4% in the three months ended September compared to the previous quarter.

That's better than economists expected, and a notch faster than the 0.3% rate posted in both the first and second quarters.

The pound gained 0.3% against the dollar following the release.

3. Ransomware attack: The U.S. government has issued a warning about a new ransomware attack that has spread through Russia and Ukraine and into other countries.

Cybersecurity experts said the ransomware -- which posed as an Adobe update before locking down computers and demanding money for people to get their files back -- targeted Russian media companies and Ukrainian transportation systems.

It has also been detected in countries including the U.S., Germany and Japan.

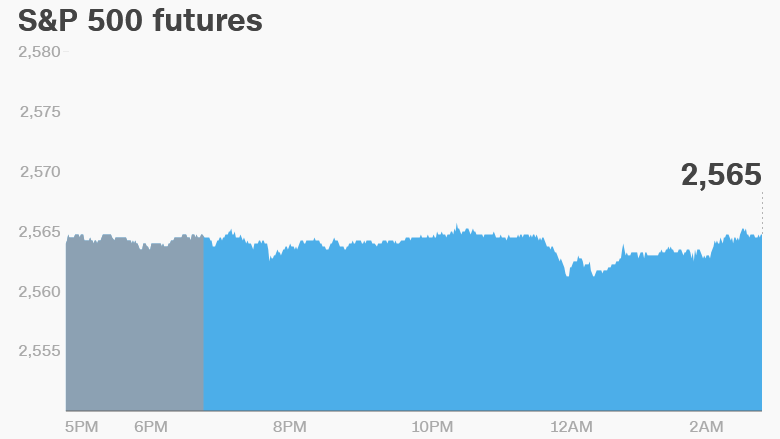

4. Market overview: U.S. stock futures were lower.

European markets opened mostly higher, following the upward trend set in Asia.

The Dow Jones industrial average added 0.7% on Tuesday to close at yet another record high.

The S&P 500 and the Nasdaq gained 0.2%.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

5. Earnings and economics: Scores of companies are reporting their quarterly results on Wednesday.

Alaska Air (ALK), Anthem (ANTM), Boeing (BA), Brinks (BCO), Coca-Cola (KO), Dr Pepper Snapple (DPS), GrubHub (GRUB), Lear (LEA), NASDAQ (NDAQ), Nielsen (NLSN), Norfolk Southern (NSC), Sirius XM Radio (SIRI), trivago (TRVG), Visa (V), Walgreens Boot Alliance (WBA) and Wyndham Worldwide (WYN) will report before the open.

AFLAC (AFL), Ethan Allen (ETH), Fidelity National (FNF), Las Vegas Sands (LVS), Nutrisystem (NTRI) and O'Reilly Auto (ORLY) will follow after the close.

The U.S. Census Bureau plans to release its September report on new home sales at 10 a.m. ET.

The weekly U.S. crude inventories report will follow at 10:30 a.m.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Wednesday -- Coca-Cola, Walgreens, Boeing and Visa earnings; ECNY luncheon with Wilbur Ross

Thursday -- Mattel, Twitter, Alphabet, Microsoft, Intel, Comcast, Ford, Southwest, American Airlines, Hershey, Xerox and Amazon earnings, ECB interest rate decision

Friday -- ExxonMobil, Chevron and Merck earnings; GDP Q3 estimates