1. Tech talks about Russia: Top executives from Facebook (FB), Twitter (TWTR) and Google (GOOGL) will face questions from Congress on Tuesday afternoon over how their platforms might have been used by Russia to meddle in U.S. politics.

The execs will testify at 2:30 p.m. ET before a Senate Judiciary subcommittee.

Facebook is expected to tell lawmakers that roughly 126 million Americans may have been exposed to content generated on its platform by the Russian government-linked troll farm known as the Internet Research Agency between June 2015 and August 2017.

2. Qualcomm gets quashed: Shares in Qualcomm (QCOM) were down about 7% premarket following reports that Apple (AAPL) is looking to stop using the company's components in its new iPhones and iPads.

Such are the perils faced by Apple suppliers. Earlier this year, shares in British firm Imagination Technologies (IGNMF) fell by as much as 72% in a single day after investors learned that Apple planned to stop licensing the firm's technology.

3. Big day for earnings: Wall Street will be hearing from Aetna (AET), Kellogg (K), Pfizer (PFE), MasterCard (MA) and Under Armour (UA) before the opening bell. Electronic Arts (EA), Sturm Ruger (RGR) and Papa John's (PZZA) will follow after the U.S. close.

International markets are digesting updates from firms including Airbus (EADSF), BP (BP), WPP (WPPGY), Ryanair (RYAAY), Samsung Electronics (SSNLF) and Sony (SNE).

Shares in BP (up 3.5%) and Ryanair (up nearly 6%) were the biggest movers of the bunch in Europe.

Samsung shares gained nearly 2% and hit a new record high after it reported earnings. The company, which is attempting to get back on track following a massive corruption scandal in South Korea, also reshuffled its management by choosing three new execs to lead key divisions.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Economics: The monthly S&P Case-Shiller Home Price Index will be released at 9 a.m., giving investors insight into the state of the U.S. housing market.

The U.S. Conference Board is releasing its consumer confidence data for October at 10 a.m.

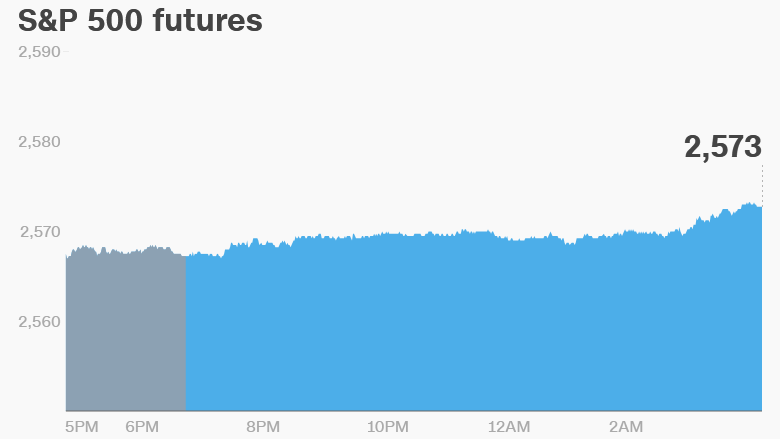

5. Global market overview: U.S. stock futures were inching up. European markets were higher in early trading.

Asian markets weren't feeling the love, and most indexes ended the day with small losses.

The Dow Jones industrial average dropped 0.4% on Monday, the S&P 500 dipped 0.3% and the Nasdaq was little changed.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Tuesday -- Aetna (AET), Pfizer (PFE), MasterCard (MA), Electronic Arts (EA), Sturm Ruger (RGR) and Papa John's (PZZA) report earnings

Wednesday -- Facebook (FB), Tesla (TSLA) report earnings; House releases tax reform bill

Thursday -- Apple (AAPL), Starbucks (SBUX), Yum! Brands (YUM), Ralph Lauren (RL), CBS (CBS) earnings

Friday -- October jobs report; iPhone X hits stores