1. Fed focus: Wall Street is watching the Federal Reserve, which will release its latest decision on interest rates and monetary policy at 2:00 p.m. ET.

Investors are expecting there will be no change to policy this time around, but another rate increase could come in December.

"The Fed has raised rates twice since January and [there are] forecasts [for] one more hike by the end of the year as part of a tightening cycle that began in late 2015," wrote FxPro analysts in a daily research note.

Thursday promises to be an even bigger day for the central bank: That's when President Trump is expected to announce his choice for Fed chair.

2. Stock markets roar: It's rare to see global stocks rising in unison, but that's the situation on Wednesday.

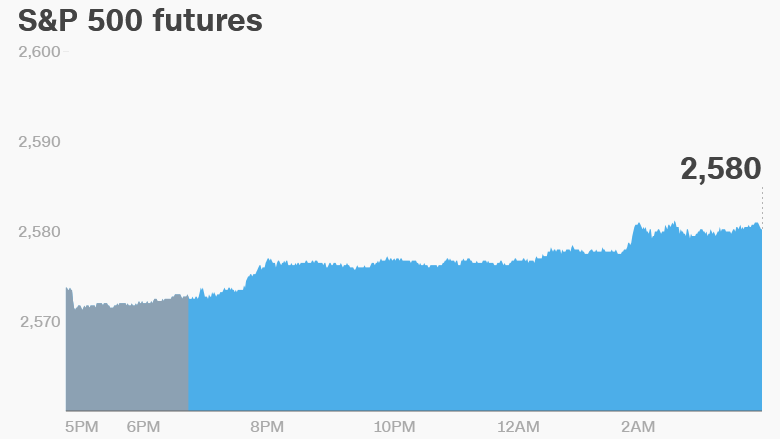

U.S. stock futures were pushing higher, setting markets up for potential records.

European markets made a strong showing in early trading. Germany's Dax index led the way with gains of roughly 1.4%.

Asian markets also ended the day in positive territory.

The Dow Jones industrial average and S&P 500 inched up by 0.1% on Tuesday, while the Nasdaq rose by 0.4% to hit an all-time high.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Taxes and tech: Republican lawmakers have delayed the release of their tax reform bill until Thursday because they are still negotiating key provisions in the bill.

It's a setback for GOP leaders who have been focused on tax reform and enthusiastically touted the November 1 announcement.

Investors want to see whether the Republicans are able to effectively implement their policies, and get a sense of how any tax changes could impact the wider economy.

Meanwhile, tech firms remain in the spotlight.

At 9:30 a.m. and again at 2 p.m., top legal executives from Facebook (FB), Twitter (TWTR) and Google (GOOGL) will testify before the Senate and House Intelligence Committees.

The execs are in Washington this week to answer questions on how foreign nationals used social media in an attempt to meddle in the 2016 presidential election.

At the first hearing on Tuesday, the tech companies were pressed on their ability to prevent bad actors from taking advantage of their platforms through ads and regular posts.

4. Earnings: New York Times (NYT), Estee Lauder (EL) and SodaStream (SODA) will report earnings before the opening bell.

Tech firms including Facebook (FB), Tesla (TSLA), Fitbit (FIT), Yelp (YELP) and GoPro (GPRO) will report after the closing bell. They will be joined by a number of food and restaurant firms, including Kraft Heinz (KHC), Shake Shack (SHAK) and Cheesecake Factory (CAKE).

Sony (SNE) shares trading in Tokyo surged by 11% following well-received results.

Investors will also be monitoring the latest October U.S. auto sales data, which will be released throughout the day.

Download CNN MoneyStream for up-to-the-minute market data and news

5. Coming this week:

Wednesday -- Facebook (FB), Tesla (TSLA) report earnings

Thursday -- Apple (AAPL), Starbucks (SBUX), Yum! Brands (YUM), Ralph Lauren (RL), CBS (CBS) earnings; House releases tax reform bill

Friday -- October jobs report; iPhone X hits stores