1. New Fed chair? President Trump will announce his pick to lead the Federal Reserve at 3:00 p.m. ET.

"I think you'll be extremely impressed by this person," Trump said.

Two sources have told CNN that Trump is likely to nominate Jerome Powell to lead the central bank.

Powell has been a Fed governor since 2012 and previously served as Treasury official under President George H.W. Bush.

If confirmed, he would replace current chairwoman Janet Yellen when her term expires in February.

Greg Valliere, chief global strategist at Horizon Investments, said Yellen would leave the Fed with a solid track record.

"She'll go out on top, widely praised for engineering an economic recovery and presiding over a historic stock market rally," he said.

2. U.K. braces for rate hike: The Bank of England has raised interest rates for the first time in a decade.

The central bank hiked rates to 0.5% in a bid to control inflation, which has shot up to 3%.

Higher interest rates will benefit savers in the U.K., who have for years seen paltry returns on their deposits. But it will also make borrowing more expensive for consumers who are already facing tighter household budgets.

Some analysts fear the bank bank have acted too soon.

The pound was trading 1% lower against the dollar following the announcement.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Tax reform unveiled: Republican lawmakers are expected to release their tax reform bill Thursday following a delay.

Investors want to see whether the Republicans are able to effectively implement their policies, and get a sense of how any tax changes could impact the wider economy.

4. Earnings: Alibaba (BABA), DowDuPont (DWDP) and Yum! Brands (YUM) will report earnings ahead of the opening bell.

Apple (AAPL), Starbucks (SBUX), CBS (CBS) and RE/MAX Holdings (RMAX) will follow after the close.

5. Stock market movers -- Tesla, GoPro: Shares in Tesla (TSLA) look set to drop sharply at the open after the electric automaker reported quarterly results and gave a disappointing outlook for production of its Model 3.

"While we continue to make significant progress each week in fixing Model 3 bottlenecks, the nature of manufacturing challenges ... makes it difficult to predict exactly how long it will take for all bottlenecks to be cleared," the company said in a letter to investors.

Tesla was already facing backlash from its shareholders over its slow production of the mass market Model 3.

GoPro (GPRO) stock is also set for a 10% tumble when trading begins after the company released results on Wednesday.

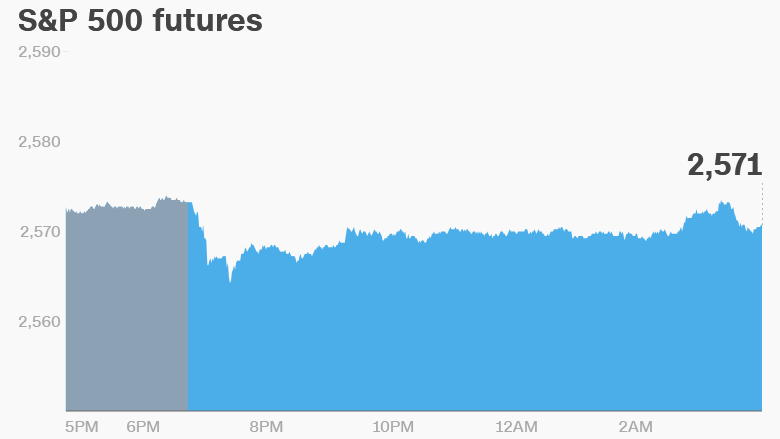

6. Global market overview: U.S. stock futures were a bit soft after major indexes touched record highs on Wednesday.

The Dow Jones industrial average, S&P 500 and Nasdaq each hit highs during the trading day before losing steam.

European markets were mixed in early trading on Thursday. Most Asian markets ended the day with losses.

Download CNN MoneyStream for up-to-the-minute market data and news

7. Coming this week:

Thursday -- Apple (AAPL), Starbucks (SBUX), CBS (CBS) earnings

Friday -- October jobs report; iPhone X hits stores