1. China flexes: The world's second-largest economy grew 6.9% last year, beating analyst expectations.

China's performance was helped by government stimulus and an improving environment for global trade.

It's the first time since 2010 that China's official growth rate has bested the prior year. The economy grew 6.7% in 2016.

Chinese stocks gained Thursday, with Hong Kong's Hang Seng hitting a record high. The Shanghai Composite rose to its highest level in over two years.

2. U.S. government shutdown risk: House Republican leaders are moving toward a vote Thursday to avoid a government shutdown.

But it's unclear if GOP leaders have enough support to keep the government open.

If Congress doesn't send a bill to the president approving more money by midnight on Friday, most federal agencies will be forced to stop operations.

A shutdown could derail a major market rally.

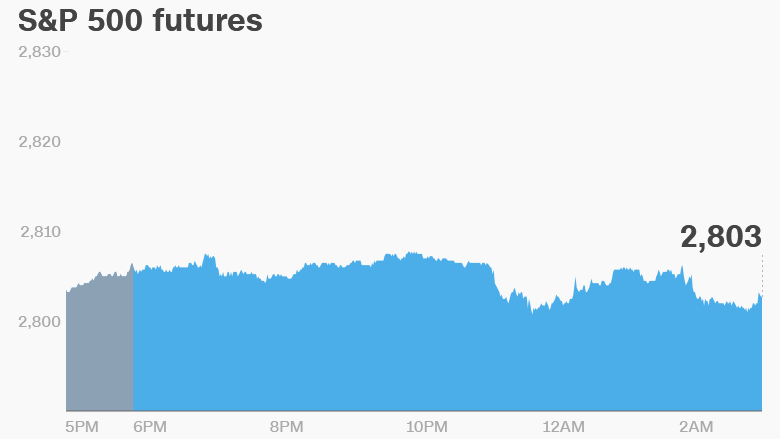

U.S. stock futures were soft ahead of the open. The Dow Jones industrial average, S&P 500 and Nasdaq all hit record highs on Wednesday.

The Dow soared by 323 points yesterday to close above 26,000 for the first time.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Earnings: Morgan Stanley (MS) will release earnings before the open, with American Express (AXP) and IBM (IBM) following after markets close.

Investors will be watching earning to see how companies assess new U.S. tax rules.

IBM, which has made a lot of money abroad, could report a big one-time hit because of a new tax on overseas earnings.

American companies with global operations are expected to pay hundreds of billions of dollars on the overseas profits they've amassed in recent decades.

But most companies say the tax changes are a good thing in the long run.

Apple (AAPL) said Wednesday it would make a $38 billion tax payment in relation to new tax rules.

Download CNN MoneyStream for up-to-the-minute market data and news

4. Coming this week:

Thursday -- Morgan Stanley (MS), IBM (IBM) earnings

Friday -- January consumer sentiment report released by the University of Michigan