1. Wild stocks: It's been a week of absolute shock and awe on global markets. What's next?

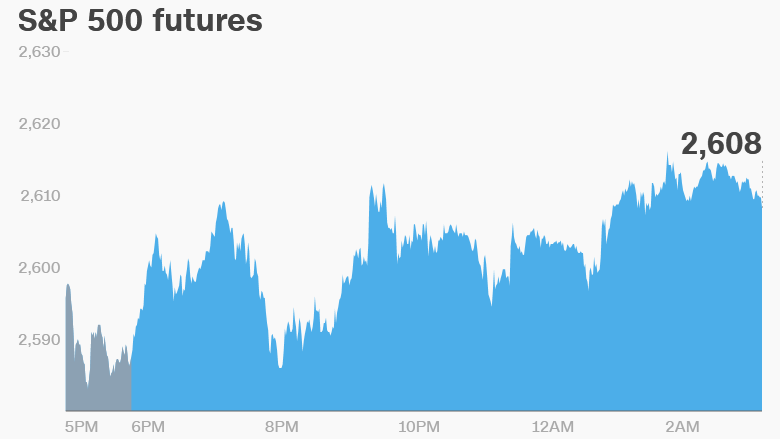

U.S. stock futures had dipped into negative territory by 7:30 a.m. ET.

The Dow, S&P 500 and Nasdaq have lost between 8% to 9% over the past five trading days, erasing all the gains made in 2018. Thursday was particularly painful and the Dow lost over 1,000 points.

Investor concerns about inflation have contributed to the volatility.

The market turmoil follows a prolonged period of booming stock prices with virtually no sharp declines. Market analysts had warned that a pullback was overdue.

2. Global stock markets: The turmoil in the United States has been contagious.

European markets were suffering losses, with London's FTSE down by about 0.8% and Frankfurt's DAX off by 1.7%.

Things were a lot uglier in Asia, where stocks dropped roughly 2% in Tokyo, 3% in Hong Kong and 4% in Shanghai.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Another government shutdown: The U.S. government shut down for the second time in 2018, but it ended quickly.

Congress approved a major budget deal early Friday morning to end the government shutdown and sent the measure to President Trump for his signature.

The colossal bill, which lawmakers had been negotiating for months, is a game-changing piece of legislation. It clears the decks for Congress in dealing with major spending issues as well as doling out disaster relief money and hiking the debt ceiling.

4. Stock market movers -- Nvidia, Expedia: Two of the biggest movers in the U.S. could be Nvidia (NVDA) and Expedia (EXPE).

Shares in Nvidia are set to surge by about 9% after the company reported better-than-expected earnings on Thursday afternoon.

Shares in Expedia were poised to fall by 19% after the company's earnings missed expectations.

5. Earnings: It's a light day for earnings. PG&E (PCG) and Moody's (MCO) are the two key firms reporting results before the opening bell.

6. Walmart looks east?: Walmart (WMT) could be looking to invest in India's biggest online retailer, Flipkart.

Bloomberg and other news outlets have reported the U.S. retailer is considering investing billions for a minority stake in the company.

Flipkart said it would "not comment on rumors or speculations." Walmart did not immediately respond to a request for comment.

Download CNN MoneyStream for up-to-the-minute market data and news

7. Coming this week:

Friday -- PyeongChang 2018 Winter Olympics begins; Apple's HomePod goes on sale