1. Powell takes the stage: Jerome Powell, the new chairman of the Federal Reserve, makes his first appearance on Capitol Hill in his new role on Tuesday.

Every Fed chair goes before Congress twice a year to report on the state of the economy. Investors will be paying even closer attention this time for clues on how quickly the Fed might raise interest rates if inflation picks up.

Powell's prepared testimony is released at 8:30 a.m. ET. Powell is scheduled to answer questions from the House Financial Services Committee later Tuesday, then the Senate Banking Committee on Thursday.

Coincidentally, former Fed chairs Janet Yellen and Ben Bernanke are scheduled for a public conversation on Tuesday at the Brookings Institution at 2 p.m. ET.

"What they say when unconstrained by politics will be market relevant," said Paul Donovan, global chief economist at UBS Wealth Management.

2. Takeover tussle: Comcast just crashed Rupert Murdoch's efforts to take control of European broadcaster Sky. (SKYAY)

Comcast (CMCSA) announced Tuesday a bid for Sky worth £12.50 per share, beating the £10.75 per share offered by Murdoch's 21st Century Fox (FOX). Sky's shares soared more than 20% on the news.

Murdoch has been trying for years to take full control of Sky, but its latest bid for the 61% of the company it doesn't already own has run into opposition from regulators.

"We expect this [Comcast] deal to go through as we do not think Fox ... will want to get into a bidding war, especially given the complications surrounding Sky News," said Liberum analyst Ian Whittaker.

Comcast's challenge could also complicate Disney's (DIS) $52 billion bid for a huge chunk of Fox's assets, which includes Fox's stake in Sky.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. South Africa changes: Investors are watching South Africa after President Cyril Ramaphosa made major changes to his cabinet, bringing back two former respected finance ministers.

Nhlanhla Nene is back in his former job as finance minister. Pravin Gordhan is now minister of public enterprises.

South African shares moved higher Tuesday and the country's currency is trading around a three-year high.

4. Earnings: Discovery (DISCA), Macy's (M), SeaWorld Entertainment (SEAS) and Vitamin Shoppe (VSI) are set to release earnings before the open Tuesday.

Then after the close we'll get results from Etsy (ETSY), Express Scripts (ESRX), Hertz Global (HTZ), IMAX (IMAX), Live Nation (LYV), Papa John's (PZZA), Booking Holdings (PCLN) (formerly Priceline) and Weight Watchers (WTW).

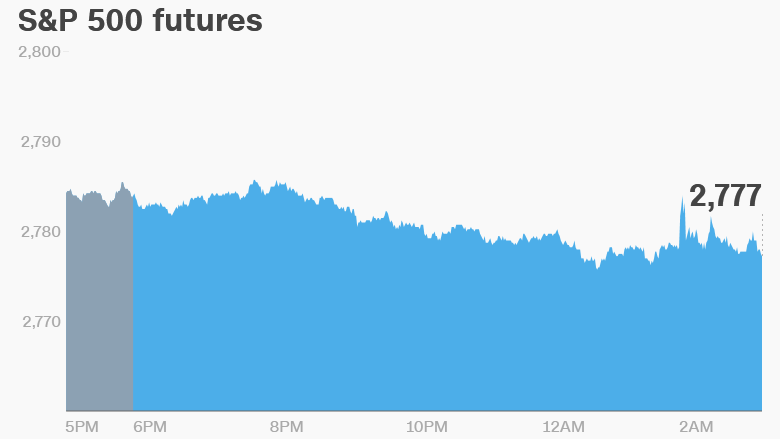

5. Global stock market overview: It looks like the recovery rally has run out of steam on Tuesday.

US stock futures are dipping down.

European markets are muddled in early trading and most Asian markets ended the day in the red.

This comes after the Dow Jones industrial average, S&P 500 and Nasdaq all surged by more than 1% on Monday.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Tuesday — Earnings from Macy's (M), Booking Holdings (PCLN) (formerly Priceline), Express Scripts (ESRX) and Discovery Communications (DISCA); Fed chair Jerome Powell testifies before the House Financial Services Committee

Wednesday — Second estimate of US Q4 GDP; Earnings from Lowe's (LOW), TJX (TJX), Salesforce (CRM), L Brands (LB), Monster Beverage (MNST) and Mylan (MYL)

Thursday — Earnings from Best Buy (BBY), Kohl's (KSS), Nordstrom (JWN), Gap (GPS) and Barnes & Noble (BKS); Powell testifies before the Senate Banking Committee

Friday — Foot Locker (FL) and JCPenney (JCP) earnings