1. Powell talks, markets listen: US Federal Reserve chair Jerome Powell will appear before the Senate Banking Committee on Thursday.

The new central bank chief made investors nervous on Tuesday, when comments made before the House Financial Services Committee suggested faster-than-expected interest rate hikes.

Powell took over from former Fed boss Janet Yellen less than a month ago, and investors are still hungry for clues on how he will steer the central bank.

2. Tariff talk: President Trump could slap new, high tariffs on steel and aluminum imports on Thursday, according to media reports.

The Commerce Department sent Trump several recommendations last month, including across-the-board tariffs and stiffer targeted penalties on certain nations that sell steel and aluminum in the US.

Both metals are crucial raw material for autos, airplanes and appliances made in the US. The construction, oil and utility industries use the metals for beams, pipelines and wires, as well as cans for food and drinks.

Imports make up about a third of the 100 million tons of steel used by American businesses every year.

"Trade protection [of this kind] remains a key risk to our generally optimistic economic and market view," said Paul Donovan, global chief economist at UBS Wealth Management. "The trend towards protectionism is ... worrying for markets."

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Earnings: AMC Entertainment (AMC), Barnes & Noble (BKS), Best Buy (BBY), Kohl's (KSS) and Sotheby's (BID) will report quarterly results.

Gun-maker American Outdoor Brands (AOBC), along with Equifax (EFX), Gap (GPS) and Nordstrom (JWN) will release earnings after the close.

Shares in Anheuser-Busch InBev (BUD) shot 6% higher in Brussels after the brewer reported results.

Shares in advertising conglomerate WPP (WPP) were down 14% in London after it told investors that 2017 "was not a pretty year."

4. Auto focus: US auto manufacturers will report February sales data on Thursday.

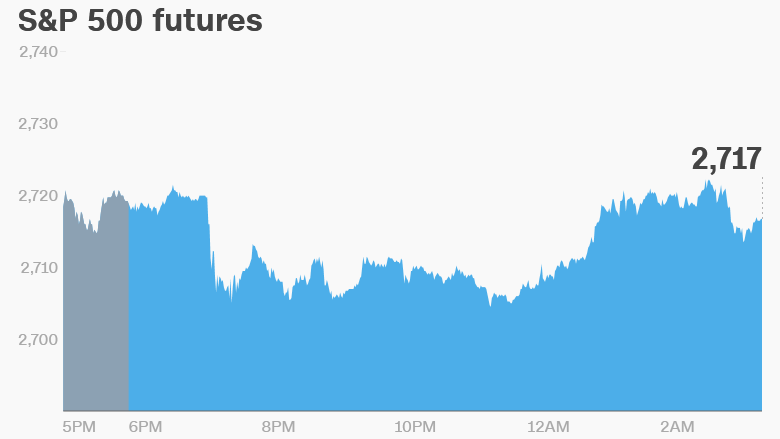

5. Global market overview: US stock futures were soft and European markets dipped in early trading.

Asian markets ended the day with mixed results.

The Dow Jones industrial average dropped 1.5% on Wednesday and the S&P 500 and Nasdaq also declined.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Thursday — Earnings from Best Buy (BBY), Kohl's (KSS), Nordstrom (JWN), Gap (GPS) and Barnes & Noble (BKS); Powell testifies before the Senate Banking Committee

Friday — Foot Locker (FL) and JCPenney (JCP) earnings