1. Trade war fears: Wall Street is bracing for more fallout from President Donald Trump's tariff announcements.

US Treasury Secretary Steve Mnuchin calmed nerves a little on Sunday, telling Fox News that he was "cautiously hopeful" the United States and China could reach an agreement that would avert the tariffs.

"As President Trump said, we're not afraid of a trade war, but that's not our objective," he said.

Trump said Thursday that he would impose tariffs on about $50 billion worth of Chinese imports after accusing the world's second biggest economy of stealing US intellectual property.

On Friday, Trump's global tariffs on steel and aluminum, which also include China, went into effect. China has announced its own tariffs on $3 billion worth of US imports.

2. Shanghai oil trading: The Shanghai International Energy Exchange launched crude oil futures trading on Monday. It's the first time oil futures will be traded in Asia, with prices settled in Chinese yuan.

Data from Wood Mackenzie show China surpassed the United States to become the world's largest importer of crude in 2017. Its import requirements are expected to grow by more than any other country over the next five years.

"China would want to play a more active role in influencing the price of crude oil," said Sushant Gupta, Wood Mackenzie's research director.

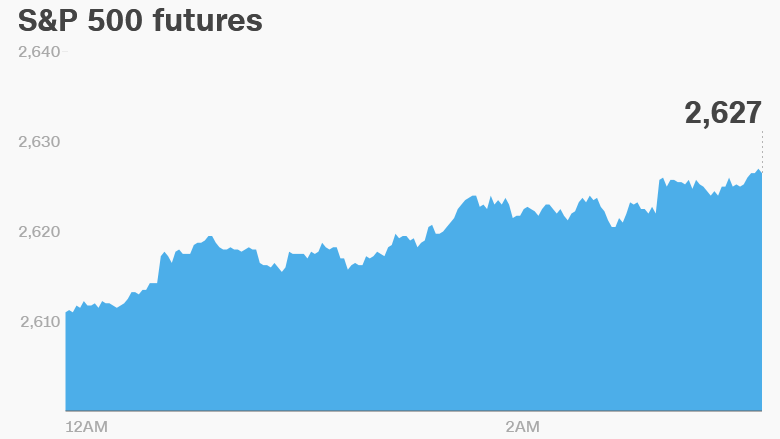

3. Global market overview: US stock futures were pointing up.

Markets in Europe and Asia were mostly higher following heavy losses at the end of last week.

The Dow Jones industrial average closed 1.8% lower on Friday, dropping to its lowest point since November. The S&P 500 shed 2.1% and the Nasdaq declined 2.4%.

US crude futures were 0.8% lower on Monday.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Earnings and economics: Uber is selling its business in Southeast Asia to local rival Grab, the companies said in a statement Monday. Uber had already admitted defeat in China and Russia.

British retailer JD Sports Fashion has announced a deal to buy Finish Line (FINL) for $558 million. Shares in JD Sports Fashion were trading 3.5% higher in London.

Remington Outdoor Brands, one of the oldest and best-known gun makers in the world, filed for bankruptcy on Sunday. The move allows Remington to stay in business while restructuring its massive debt.

The French statistics agency said the country's economy grew by 0.7% in the fourth quarter. GDP growth for 2107 was 2%.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

5. Coming this week:

Tuesday — Lululemon earnings; US consumer confidence

Wednesday — Blackberry, Gamestop and Walgreens Boots Alliance earnings; US fourth-quarter GDP final look

Thursday — Constellation Brands earnings; UK fourth-quarter GDP final look; US personal spending and consumer sentiment

Friday — US markets closed for Good Friday