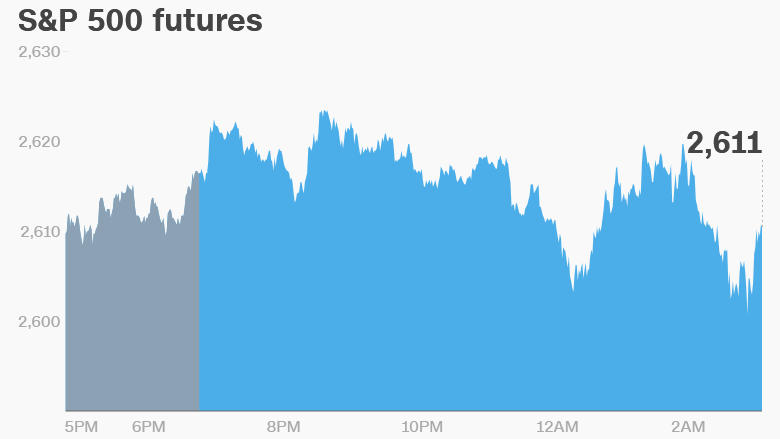

1. Buckle up: It's looking like another volatile day for stocks.

US stock futures were lower after a painful trading session on Tuesday. Markets in Europe and in Asia were also firmly in the red.

"The fact that global equities roared back to life on Monday only to surrender gains yesterday, continues to highlight how extremely skittish the market is currently," said Lukman Otunuga, a research analyst at FXTM.

The Dow dropped 1.4% on Tuesday, while the S&P 500 declined 1.7% and the Nasdaq shed 2.9%. The losses were driven by the tech sector.

"[The tech sell off is] fueled by fears of onerous regulation on the increasingly influential sector being on its way, in the wake of the Facebook data scandal," said Mike van Dulken, head of research at Accendo Markets.

Google parent Alphabet (GOOGL), Twitter (TWTR), China's Tencent (TCEHY), Snap (SNAP), Nvidia (NVDA), Tesla (TSLA) and Netflix (NFLX) have all suffered losses this week.

CNNMoney's Fear & Greed Index, a gauge of market sentiment, has dropped further into "extreme fear" territory.

2. The latest on Facebook: Shares in Facebook (FB) have dropped over 10% in just a week.

On Tuesday, Facebook sources told CNNMoney that CEO Mark Zuckerberg has decided to testify before Congress within a matter of weeks.

The company has has been under a microscope after it was revealed that Cambridge Analytica, a data firm with ties to President Donald Trump's 2016 election campaign, reportedly accessed information from about 50 million Facebook users.

3. Oil drops: US crude futures were 1% lower at $64.60 per barrel.

Analysts attributed the drop in prices to a surprise build in inventories reported by the American Petroleum Institute on Tuesday.

The official US crude inventories report is set to be published at 10:30 a.m. ET. Investors will be watching closely for signs that the global oil glut is not going away.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Earnings and economics: BlackBerry (BB) and Walgreens Boot Alliance (WBA) are set to release earnings before the open. Gamestop (GME) will follow after the close.

The Commerce Department will release its third estimate of US fourth quarter GDP at 8:30 a.m. Analysts are expecting the reading to come in slightly stronger than the 2.5% increase reported last month.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

5. Coming this week:

Wednesday — Blackberry, Gamestop and Walgreens Boots Alliance earnings; US fourth-quarter GDP final look

Thursday — Constellation Brands earnings; UK fourth-quarter GDP final look; US personal spending and consumer sentiment

Friday — US markets closed for Good Friday