1. Roller coaster quarter: It's the final trading day of what has been an extremely volatile first quarter.

Major global indexes suffered steep losses in February, then bounced back at the beginning of March, only to tumble again in the past 10 days.

Multiple factors are fueling the wild swings.

Investors are worried that the United States and China might be gearing up for a trade war.

The US Federal Reserve may also raise interest rates faster than previously expected.

This week, concerns over privacy standards at big tech companies have weighed heavily on the markets.

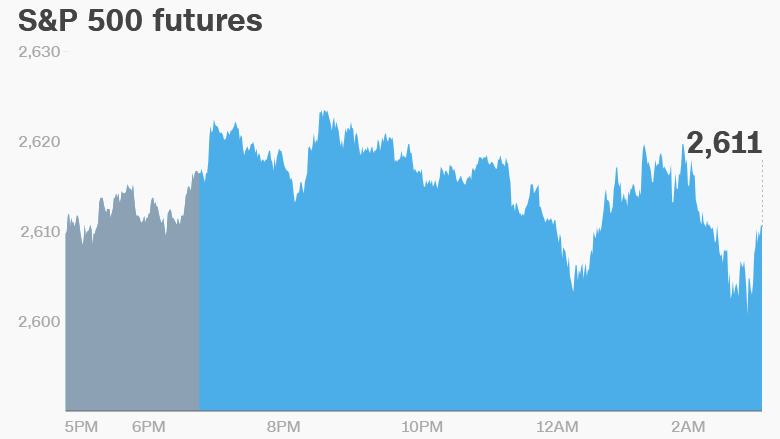

US stock futures were pointing higher on Thursday. Most European and Asian markets advanced.

The Dow closed flat on Wednesday, while the S&P 500 dropped 0.3% and the Nasdaq shed 0.9%. US markets are closed Friday.

2. One year to Brexit: Britain is leaving the European Union on March 29, 2019 -- a year from Thursday.

Divorce negotiations are well underway, but many key issues have not been settled.

Industry bodies are urging the negotiators to step up their efforts to make sure the United Kingdom doesn't crash out of the union without a trade deal. That would have costly consequences for businesses and the wider economy.

Uncertainty is already hurting the UK economy. Growth has slowed, and the London stock market has been one of the world's worst performers in 2018.

UK GDP growth in the fourth quarter was 0.4% compared to the previous three months, according to data published Thursday.

3. Global trading giant: CME Group (CME) is buying London-based fintech company NEX Group (NEXGY) for £3.9 billion ($5.5 billion), the two companies announced on Thursday.

CME is one of the world's leading futures exchanges, while NEX operates electronic foreign exchange and fixed income cash platforms.

The deal is expected to close in the second half of the year.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Stock market movers: Shares in Renault (RNLSY) shot up 4.5% in Paris after Bloomberg reported it is in talks with Japan's Nissan to merge and trade as one corporation.

The two automakers already have a close relationship. Renault holds a 43.4% stake in Nissan, while Nissan owns 15% of Renault shares.

5. Earnings and economics: Constellation Brands (STZ) will report results before the open. Analysts expect the wine, beer and spirits company to report strong sales of Corona, bolstered by the new Corona Familiar and Corona Premier brands.

Finish Line (FINL) is also set to report before the open.

The US Bureau of Economic Analysis will release its personal income report for February at 8:30 a.m. ET.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Thursday — Constellation Brands earnings; UK fourth-quarter GDP final look; US personal spending and consumer sentiment

Friday — US markets closed for Good Friday